The “Magnificent Seven” is a group of US-based tech stocks that have dominated financial headlines in recent years thanks to their exceptional growth. While these companies have become a very important story on the global stock market, another group of stocks may be giving them a run for their money.

This new group has become known as the “Granolas” stocks.

Analysts at Goldman Sachs identified the Granolas on the European market in 2020, suggesting that they could deliver high returns in the preceding years thanks to their earnings growth, strong balance sheets, and high margins, among other factors.

Since then, the Granolas have indeed delivered high returns, causing many to draw parallels with the Magnificent Seven. So, what could this mean for you and your portfolio?

Read on to learn more about how the Granolas stocks compare to the Magnificent Seven and why diversification remains an important factor in building a robust portfolio.

The European Granolas are smaller than the Magnificent 7, but they comprise a more diversified range of sectors

Europe’s Granolas stocks include the following companies:

- GSK

- Roche

- ASML

- Nestle

- Novartis

- Novo Nordisk

- L’Oreal

- LVMH

- AstraZeneca

- Sanofi

- SAP

Hargreaves Lansdown reports that when you combine all 11 stocks, their total value makes up 19% of the European market. By comparison, the Magnificent Seven make up around a third of the much larger US S&P 500 index.

The report also reveals that the Granolas have an average price to earnings ratio of 30.5, compared to the Magnificent Seven’s ratio of 44.5. This means that the Magnificent Seven are more expensive than the Granolas stocks, and the market expects much higher growth from them.

What is interesting to note is that the two groups are quite different in terms of the sectors they include. While the Magnificent Seven are notoriously tech-heavy (including companies such as Microsoft, Alphabet, NVIDIA, and Meta), the Granolas feature stocks from a range of sectors, including healthcare, beauty, and luxury goods.

Europe’s Granolas have performed well in recent years with less volatility than the Magnificent 7

The Magnificent Seven have, as their name suggests, returned impressive gains over the past couple of years. Indeed, in 2023, they were behind the majority of global stock market growth. The Guardian reports that these stocks grew in value by 74% across 2023, compared to the 12% average growth of the rest of the world’s companies.

The Granolas have also delivered impressive returns. A report from Morningstar shares that the group accounted for 60% of the gains in European stocks between February 2023 and February 2024. It also revealed that, over a two-year period, the Granolas outperformed the Magnificent Seven.

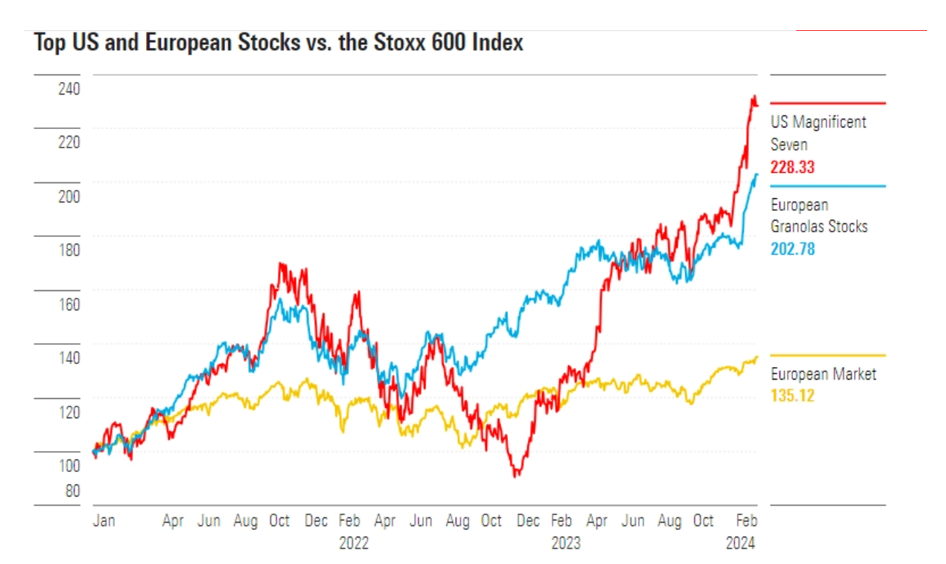

As you can see from the graph below, both the Magnificent Seven and Granolas stocks have outperformed Europe’s Stoxx 600 index between February 2023 and February 2024. The Granolas have delivered more consistent growth though, with lower volatility.

Source: Morningstar. Data correct as of 23 February 2024.

Read more: What are the “Magnificent Seven” and how could they affect your portfolio?

It’s important to ensure your portfolio is diversified to mitigate risk

When small groups of stocks outperform so substantially, it can create something called “concentration risk”. This means there is greater potential for a loss in value if one of these companies underperforms.

J. P. Morgan reports that the growth of the Magnificent Seven has increased concentration risk in the US at the fastest rate in 60 years. According to a report from CNBC, there are fears that the Granolas stocks could cause a similar problem on the European market.

Even though the Granolas stocks represent a larger number of sectors than the Magnificent Seven, it may not be sensible to allocate a large proportion of your portfolio to just 11 stocks. If any of them underperform, it may take a long time to recoup the loss.

That being said, the Granolas are driving a lot of growth, so excluding them from your portfolio entirely could hinder its growth potential.

We strongly recommend consulting your financial planner when constructing or rebalancing your portfolio. They can help you to select the most appropriate investments for your circumstances and goals, while also helping you to balance the portfolio to mitigate the risk to your wealth.

Get in touch

If you’d like to learn more about how we can help you to manage your investments so that you can make progress towards your goals, please get in touch.

Email enquiries@metiswealth.co.uk or call 0345 450 5670 today to find out what we can do for you.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.