The US technology sector has been through its fair share of ups and downs over the past few decades. But in 2023 it experienced a significant surge in value thanks to a group of stocks known as the “Magnificent Seven”.

While this is good news for you if you invest in this sector, and indeed in this particular group of stocks, it could pose a threat to diversification. The rapid growth of the Magnificent Seven has skewed the weighting of these companies within certain global tracker funds. As a result, passive investors in one of these funds could be inadvertently overexposing their wealth to this small collection of stocks.

Read on to discover more about how the Magnificent Seven have performed over the past 12 months and what it could mean for your portfolio.

The Magnificent 7 have experienced exceptional growth in 2023

The Guardian reports that the Magnificent Seven – composed of Meta (formerly Facebook), Amazon, Apple, Microsoft, Tesla, Alphabet (formerly Google), and NVIDIA – grew in value by 74% in 2023. Compare this to the 12% average growth for the rest of the world’s companies and you can begin to appreciate the scale of the matter.

The growth is attributed in part to the surge in interest in artificial intelligence (AI) in 2023. Companies across the world have quickly adopted large language models such as ChatGPT and made them a core part of their processes.

Given that AI is likely to affect most major industries and sectors, it’s not too surprising that the chip-maker NVIDIA and similar technology stocks have grown so significantly over the past 12 months.

The Magnificent 7 now make up a large proportion of one of the most popular global tracker funds

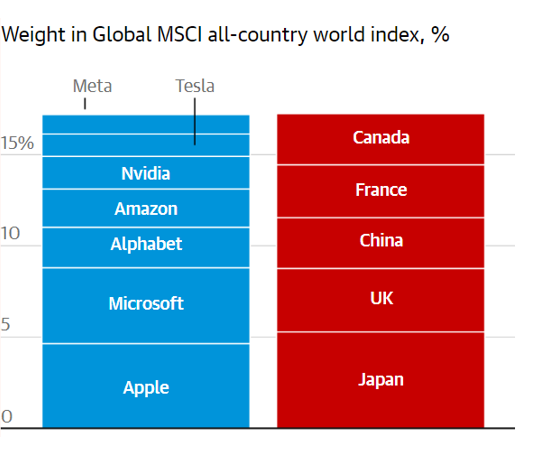

The size of the Magnificent Seven relative to other companies across the world means that, in 2023, they comprised the same proportion of the global market as the total economies of the UK, Japan, Canada, China, and France combined.

As the graph below demonstrates, if you had invested in the global MSCI all-country world index last year, a significant proportion of your money would have been in these seven companies. This is because the larger the company, the greater its weighting within the fund.

Source: The Guardian

Diversification can be tricky if you don’t pay attention to the weighting of individual stocks within a fund

One of the golden rules of investing is to ensure that your portfolio is diversified across different asset classes and geographical regions. This can help to mitigate risk, since if one sector or asset class underperforms, another might balance this out.

You might choose to do this by investing in a global tracker fund. This is a collection of investments that, in theory, includes a range of industries, sectors, and asset classes from across the world.

While this sounds like a sensible way to diversify your investments, it’s important to pay attention to the weighting of each investment within the fund.

US tech has enjoyed a bumper year, but the tides could turn quickly

Diversification is undoubtedly important, though it bears pointing out that these seven stocks were a key driver of global market growth in 2023. Without them in your portfolio, your returns may have been somewhat disappointing.

This means it may be tempting to move more of your money into the Magnificent Seven in the hopes of continuing to profit from their success. But keep in mind that it is impossible to predict what might happen next across the market and for individual stocks.

To give your money the greatest opportunity to grow, any changes you make to your portfolio need to be aligned with your personal goals as well as your risk tolerance.

A balanced portfolio that is appropriately diversified can help you to grow your wealth sustainably, mitigating risk and potentially bringing you closer to achieving your long-term goals.

Get in touch

Working with a financial planner can help you to make sensible choices about your investment portfolio so that your money has the opportunity to grow while mitigating the risks it is exposed to.

If you’d like to learn more about how you can create a portfolio that is aligned with your needs, goals, and risk tolerance, we can help.

Email enquiries@metiswealth.co.uk or call 0345 450 5670 today to find out what we can do for you.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.