Working with a financial planner has many benefits, but did you know that it could also help you to feel calmer and more confident about the future?

During times of economic uncertainty, you might experience difficult emotions and feel nervous about the future. But by working with your planner to understand what is happening and how you can protect your wealth, you can reduce the impact these feelings have on your financial and emotional wellbeing.

Read on to learn more about how your planner can support you if you’re feeling worried about economic events affecting your wealth.

The past few years have been a turbulent time for the UK economy

National and global events over the past few years have all had an impact on the economy, including the Covid pandemic and the Russian invasion of Ukraine. As a result, inflation rose to a peak of 11.1% in October 2022, causing the Bank of England (BoE) to raise interest rates in an attempt to bring inflation back to its target of 2%.

Though inflation has since fallen – the latest figures from the Office for National Statistics indicate that it fell to 3.2% in March 2024, down from 3.4% in February – it remains above the BoE’s target of 2%.

Figures reported by the BBC show that the economy fell into a technical recession in the second half of 2023, after it contracted for two consecutive quarters. Though the governor of the BoE has shared the good news that the economy appears to already be recovering, he also stated that the bank is unlikely to cut interest rate any time soon.

So, while things are starting to look a little brighter, interest rates could remain higher for longer than initially anticipated.

Even though the economy is recovering, many are worried about how it could affect their wealth

Figures reported in FTAdviser show that the majority of affluent people are concerned about the economy and its impact on their wealth.

A survey of 500 people with a net worth of £100,000 or more found that 87% were worried about the economy. Moreover:

- 51% were unsure if they would be able to maintain their lifestyle in later life

- 39% were worried about preserving the value of their investments

- 25% were thinking about how to provide for their children and grandchildren.

So, if you’re worried about how economic events might affect your wealth, you’re not alone. But working with a financial planner could help you put your mind at ease.

Your financial planner can help put economic events and headlines into perspective

It’s natural to feel nervous if you see headlines about recession or other economic events that might negatively affect your wealth.

The headlines you read are designed to capture your attention by stirring up fear and panic – two emotions that are particularly unhelpful when it comes to making sensible decisions about your money.

The important thing to remember is that you don’t have to deal with this on your own. Your financial planner is here to help you by creating a robust financial plan that is able to withstand economic headwinds. They can also shed light on worrying headlines by explaining exactly what is happening in the economy and how it could affect you.

For example, many worrying headlines tend to forecast an imminent change or threat to the economy. But CNBC reports that forecasts are rarely – if ever – correct, stating “Wrong forecasts are the norm, not the exception”.

Your financial planner can help you to discern the headlines that are based on predictions from those that deliver timely and helpful news.

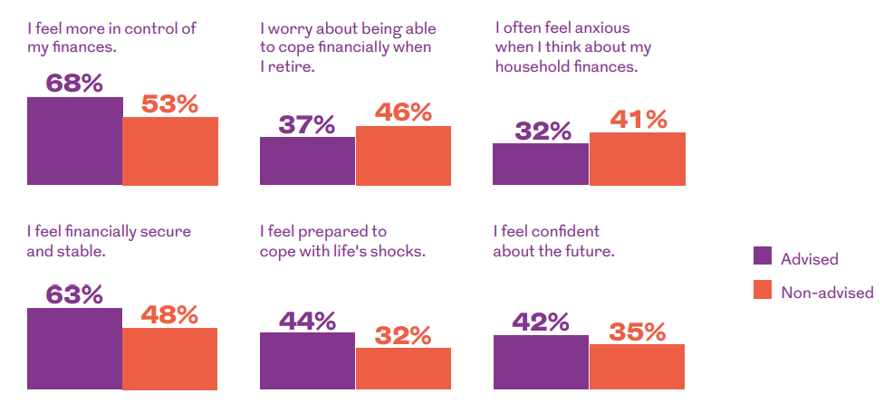

People who have taken financial advice report feeling more confident about their money

If you’re feeling concerned about how economic events might affect your wealth, consulting your financial planner could be a helpful way to allay these fears.

Research from Royal London shows that people who have taken professional financial advice are more likely than those who hadn’t to feel:

- In control of their finances

- Confident about the future

- Financially secure and stable

- Able to cope financially when they retire

- Prepared to cope with unexpected events.

Source: Royal London

What’s more, the results were comparable regardless of the level of household income that respondents had. Those with higher incomes experienced a similar benefit to those with lower incomes.

So, as well as helping you to make sensible decisions about your wealth, your planner can help you to feel reassured and confident about the future – no matter how the economy performs.

Get in touch

If you’d like to learn more about how we can reduce your worries about the economy and help you feel confident in your financial future, please get in touch.

Email enquiries@metiswealth.co.uk or call 0345 450 5670 today to find out what we can do for you.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.