When times are tough, it can be easy to worry about your portfolio. After all, when you’ve worked so hard to build it, the last thing you want is for market volatility to cause its value to fall. That’s why you might be tempted to transfer your wealth into “safer” assets, such as cash.

In the past few months, some investors have opted to buy commodities, such as precious metals, which they hope will protect their wealth from market volatility. In practice, however, gold is often a highly speculative asset that isn’t always as lucrative as it may seem.

If you’re worried about the recent economic turbulence and you’re tempted to invest in precious metals, read on to find out why all that glitters is not gold.

Low interest rates and high inflation make holding wealth in cash unattractive

During times of uncertainty, people often flock to safe assets. One of the most traditional is cash, but holding too much of this can also be a risk. While your capital may be safe from market shocks, low interest rates mean that your money is unlikely to keep up with the rate of inflation.

As of 10 June, market data from Moneyfacts shows that the highest interest rate for an easy access savings account was just 1.52%. At the same time, according to figures from the Office for National Statistics, the Consumer Price Index (CPI) stood at 9% in the year to April 2022.

Due to this issue, some investors have chosen to buy gold and other precious metals instead.

Historically, commodities like these have been seen as safe havens that preserve wealth when times are hard. Furthermore, price rises in recent years have convinced some people that gold could even be a growth asset.

This all sounds ideal, but as you’ll know, if something seems too good to be true that’s because it often is.

Unlike traditional investments, the price of gold is determined by common consent

The root of the problem is that gold isn’t really an investment in the traditional sense, as it doesn’t actually produce anything or yield an income. While it has some industrial application in electronics, it’s really only valuable because society agrees it is.

At the end of the day, if you buy gold then any returns you see will be based entirely on its price appreciating. Compare this to shares in corporations that are driven by research, innovation, growth and actual earnings.

As the renowned investor Warren Buffett famously remarked: “The problem with commodities is that you are betting on what someone else would pay for them in six months.”

On top of this, you’ll also have to factor in the cost of storing your gold and insuring it against loss or theft. This can potentially be very expensive and will eat into any returns that you might see.

Compare this prospect to investing your money in equities. You do some careful research, compare your investing options, and then buy stocks in the businesses that you think will perform well.

If the companies you invested in succeed and grow, the value of your investment will rise. This is much more tangible than the changing price of commodities, which are essentially determined by collective consent.

The key difference is that companies produce things that people need – AstraZeneca makes life-saving pharmaceuticals, say, while BP extracts oil and refines it into the fuel that our cars run on. Gold, on the other hand, simply sits in a vault while you hope it increases in value.

In the long term, stocks and shares typically outperform commodities

Another important reason why traditional investments, such as equities, can be better for your long-term wealth is that they typically outperform commodities over time.

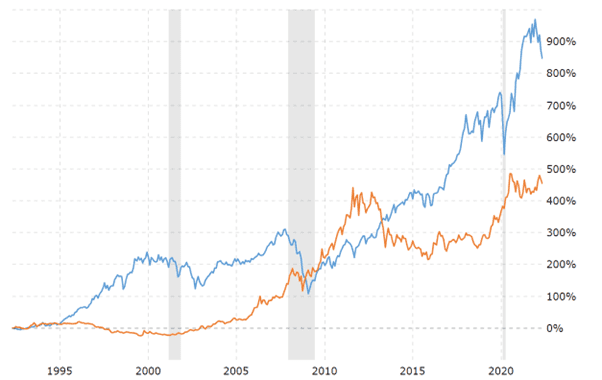

The graph below shows the performance of the Dow Jones Industrial Average Index (blue) and the price of gold (orange) over the past 30 years. The grey bars represent periods of economic recession, such as after the 2008 financial crisis.

Source: Macrotrends

As you can see, while the price of gold has increased by around 450% in that time, the Dow Jones rose by almost double that amount.

Think about taking a long-term view and staying invested

Since the value of gold doesn’t typically grow as quickly as stocks and shares, investing in it can slow down your progress towards your financial goals. This is why it’s often more sensible to stay invested in the stock market and avoid the temptation to buy commodities.

While it can be easy to worry about your portfolio during periods of volatility, it’s important to take a long-term view. As we often say, it’s “time in the market”, not “timing the market”, that really matters.

While periods of volatility may affect the value of your assets, the upwards trend of markets is likely to override the effects of any dips in the long term. As difficult as it might be, the most sensible thing you can often do is to hold your nerve and ride out the economic turbulence instead.

One of the ways we protect your portfolio from the effects of market volatility is by diversifying the assets it contains. Simply put, this is the act of not putting all your eggs in one basket!

A diverse portfolio is one that contains a variety of asset classes with differing levels of risks, as well as investments from across a wide range of industries and sectors in countries across the globe.

One of the main benefits of diversification is that it can reduce the impact that an economic shock could have on your wealth. By spreading out your investments, you can help to ensure that a market downturn only affects a portion of your portfolio.

On top of this, a fall in one area could even be offset by improved performance in another!

Knowing that your portfolio is properly diversified can help you to rest easy, knowing that you’re on track to reach your goals and can overcome any short-term dips in the market.

Get in touch

If you’re concerned about market volatility and want to know more about how we can protect your wealth, get in touch. Please email enquiries@metiswealth.co.uk or call 0345 450 5670.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.