As the cost of living crisis tightens its grip on the UK, many people are already seeing their finances stretched.

Professional Adviser recently reported that 44% of UK investors have sold their shares in response to rising inflation. This is Money, meanwhile, confirms that those under 40 are most likely to offload their shares to cope with rising living costs.

You might be tempted to do the same. Remember, though, that an investment is a long-term proposition and selling shares earlier than planned could cost you in the long run.

In fact, Forbes reports that an “impatience tax” could have cost UK investors £1.3 billion over the past year alone.

Keep reading to find out why remaining patient is so important.

Knee-jerk reactions now can affect your financial wellbeing

Remaining unemotional is a key part of successful long-term investing. So too is managing risk. When the stakes are high and your money is on the line, the kind of stock market instability we’ve seen over the last couple of years can be worrying.

From the Covid downturn to the recent drop in the pound following the government’s largely abandoned Growth Plan 2022, the markets have experienced plenty of short-term blips. But the general trend of markets is upwards.

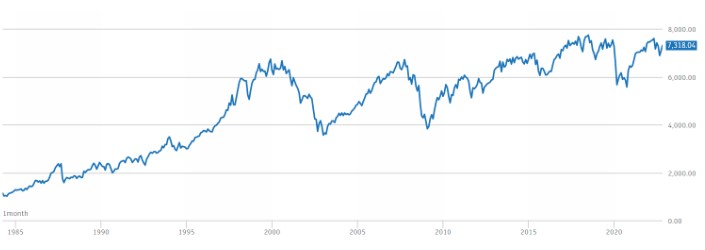

This is demonstrated by looking at the FTSE 100 over the last 40 years.

Source: London Stock Exchange

The pandemic dip of 2020 is clearly visible but so is that of the 2008 global financial crisis and the influence of the Iraq war in 2003.

You can see that the dips tend to be short sharp shocks, whereas the periods of growth last much longer.

Investors that reacted emotionally to any of the FTSE 100 dips shown here – and rushed to sell off their holdings – would likely have missed out on the subsequent market rises. This could affect the chances of an investor attaining their goal, with consequences for their financial and emotional wellbeing.

Patience is the key to investing

It’s important to remember that a successful investment isn’t one that makes the highest returns as quickly as possible. Instead, it is one that allows you to achieve your long-term goal while taking a level of risk that you are comfortable with.

This strategy requires patience but has its ultimate rewards.

Periods of volatility are to be expected. In fact, they are the reason that we recommend an investment over a longer term. A lengthier time frame allows room for recovery after periods of losses, so hanging on in there is key to your investment’s success.

Remaining invested is also more cost-effective. You’ll be saving yourself transaction fees that could quickly grow out of control for investors who are unable to remain patient.

While you might be struggling financially as living costs rise, remember that your investment strategy is aligned to a long-term goal. It is not intended to mitigate short-term woes.

At Metis Wealth, we can help you manage your household budget effectively so that you won’t need to turn to your investment portfolio.

The benefits of compounding grow over time

Albert Einstein is often quoted as saying that “compound interest is the eighth wonder of the world”. He also allegedly went on to say: “He who understands it, earns it; he who doesn’t, pays it.”

Put simply, compound growth is interest on interest. Whether you have savings or an investment, you’ll be looking to generate growth. Over the long term, compounding can make a huge difference.

When you place your cash into a savings account you expect the money to accrue interest.

Let’s say you receive 2.5% interest on a sum of £100. You’d receive £2.50. The following year, you’d receive 2.5% of your new amount (£102.50).

By year three, your £2.50 interest payment has become £2.63, and so on.

Scale these examples up in line with your invested fund and you can see how much difference compounding could make over time. This is one of the reasons why starting to invest early can be so powerful.

It is never too late to start benefiting from compound growth but remember that you’ll need to remain invested to see its true power.

Get in touch

Investing in the markets requires you to understand your long-term financial goal and your attitude to risk. It also requires enormous patience and the ability to remain steadfast when things look tough.

Riding out periods of short-term volatility gives your investment the best chance of capitalising on the market growth that follows. Staying invested also allows your money to benefit from compound growth and fewer fees.

At Metis Wealth we have experience dealing with the markets so if you are considering selling your shares as the cost of living crisis bites, get in touch now.

Please email enquiries@metiswealth.co.uk or call 0345 450 5670.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Your pension income could also be affected by the interest rates at the time you take your benefits. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.