One of the big problems with economics is that, as important as the field may be, it can often be full of jargon. That’s why if you saw the recent reports warning of a “yield curve inversion” you may not have thought much of it.

However, it could be much more important than you think. As past data shows, the behaviour of the US bond market can be a useful indicator of whether an economic crash is coming, which could seriously affect your long-term plans.

If you want to understand more about what this phenomenon is and whether it could affect you, read on to find out everything you need to know.

The yield curve shows the relationship between returns on American government bonds

To put it simply, the yield curve is a way to visualise the relationship between the returns on different types of US government bonds. As you’ll know, these typically range from ones that mature in as little as three months to ones that can take up to 30 years.

Typically, when interest rates are stable and the economy is strong, the curve slopes gently upwards. This makes sense, as bonds with a shorter duration typically have low yields while longer duration ones often give you higher returns, as your money is at greater risk from inflation.

Of course, this curve doesn’t simply remain static. Over time, its shape alters as it reflects changes in the bond market and wider economy.

As a general rule, there are three main ways that analysts describe the yield curve:

- Steepening: This is when the gap between short- and long-term bonds is rising

- Flattening: This is when the gap between short- and long-term yields shrink

- Inverted: This is when short-term bonds actually yield more than long-term ones.

As you might imagine, alarm bells start to ring when the curve flattens as it indicates an inversion could be just around the corner.

At this point, you might be wondering what’s so exciting – asset yields go up and down all the time. However, the bond yield curve is especially noteworthy, as its inversions can often be a reliable indicator of economic recessions.

The curve has flattened significantly in recent weeks

Typically, analysts tend to focus on the difference between in yield between 2-year bonds and 10-year bonds when assessing the curve. This is sometimes known as the “twos-tens spread”.

Historically, an inversion between those two has been a fairly reliable warning sign of a looming recession. According to Morningstar, when this happens an economic downturn typically follows within 12.3 months, on average.

For several weeks, the yield curve has been worryingly flat. The recent outbreak of war in Ukraine has caused inflation to spike, as the cost of food and fuel has risen sharply, which has disrupted the market.

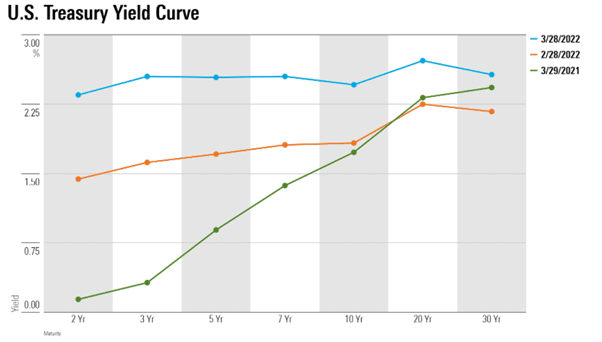

The graph below shows the yields of different types of government bonds on different dates. The green line shows the returns in March of 2021, the orange and blue lines show the returns on bonds in February and March of 2022, respectively.

As you can see, in March 3-year bonds offered a higher yield than their 5-year, 10-year, and 30-year counterparts. This flattening has made many analysts concerned that an inversion could be just around the corner.

Source: Morningstar

Needless to say, if the USA did experience a major economic downturn then it could have a major ripple effect on global markets. This is why analysts are keeping such a close eye on the performance of American government bonds.

Working with a financial planner can give you greater peace of mind

With many countries across the world still recovering from the coronavirus pandemic, a major recession in one of the largest economies in the world could pose trouble.

Of course, it’s important to remember that while this may be a worrying sign, there’s no need to panic as the inversion hasn’t actually yet happened. While the curve may be flattening, there is still time for that to change.

Even if it does, it’s important to bear in mind that the future isn’t set in stone. Even with the best modelling software and tools at your disposal, nobody can accurately predict what will happen 12 months from now. After all, nobody in January 2020 could have predicted how that year would end!

That being said, if you’re concerned about the prospect of an economic downturn then you may benefit from seeking professional advice.

When you work with a planner, they can make sure your portfolio is properly diversified. This ensures that your wealth isn’t overly exposed in any particular economic sector or geographic area, which can help to protect your assets in the event of market volatility.

This can give you greater peace of mind to know that, even if a major downturn was to happen, your progress towards your financial goals wouldn’t be affected.

Get in touch

If you want to know more about how you can protect your wealth through diversification, we can help. Please email enquiries@metiswealth.co.uk or call 0345 450 5670.

Please note:

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.