The coronavirus pandemic has put the government under a considerable amount of financial strain in recent months. Not only have they had to find the money for furlough payments and buying PPE, but also for developing the UK’s digital Track and Trace system.

As such, you might find it surprising to learn that the chancellor of the Exchequer, Rishi Sunak, has suggested the government may do away with the highest level of tax. While this may seem like it will lower the government’s tax takings at a time when they need every penny of revenue, some economic theories suggest otherwise.

Read on to find out more about why he’s considering this, as well as what it may mean for you.

Government spending has ballooned in recent months due to the pandemic

The pandemic has placed a massive financial burden on the UK government in recent months as it fought to stop the spread of the virus. According to official figures, current estimates of the cost of these measures range from £315 billion to £410 billion.

While this expense can be covered in the short term by increased borrowing, the significant interest on these loans could cause long-term financial problems for the Treasury. As such, the chancellor has had to think outside the box about ways to stimulate the economy and boost tax revenue.

While you may think that raising tax rates is a good way for the government to generate more income, this isn’t always the case. Sometimes, reducing taxes can actually be the more effective way to do so.

In some circumstances, lowering the tax rate can lead to higher tax revenues

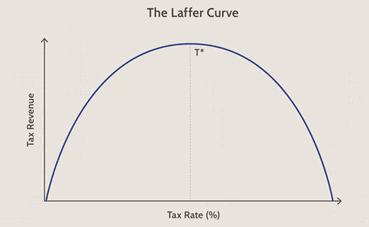

This tax theory was popularised by economist Arthur Laffer but is based on the writings of earlier writers, such as John Maynard Keynes. Essentially, he stated that the relationship between tax rates and revenue is not linear but curvilinear, as you can see on the simplified graph below.

Source: Investopedia

Taxation, Laffer argued, is a balancing act between generating revenue for the government and encouraging growth through rewarding hard work.

If the tax rate is at 0%, then the government will obviously receive no income. Conversely, however, if the rate is at 100% then people will have no incentive to work and so there will also be no tax revenue.

Somewhere in between there is a sweet spot of optimal taxation, which is represented with the T* on the image above. If a government raises taxes beyond this point, they may get diminishing returns or even a fall in revenue collected, as the move encourages people to find ways to avoid paying them.

The main takeaway of this theory is that sometimes, lowering taxes helps to both stimulate the economy and increase tax income for the government. This is what the chancellor is hoping will happen by removing the additional rate of tax.

While the government may cut Income Tax, they may try to raise revenue in other ways

As you might imagine, one of the main consequences of abolishing the top rate of tax is that if you earn more than £150,000 each year, your tax bill could fall. While this is obviously welcome news, this move may affect your wealth in other ways.

While the chancellor’s plan for long-term growth might sound good in theory, there is still one major issue. In the short term, the government could experience a large drop in tax revenue, which would obviously pose a serious problem.

While the government could increase their borrowing, this could be a hugely unpopular move.

According to the latest figures from the Office for National Statistics, published in the Guardian, in November the national debt stood at an incredible £2.3 trillion, or 96.1% of the UK’s GDP. Raising the debt further could attract strong criticism, which is why the government may hope to avoid doing so.

Abolishing the top rate of tax may lead to greater tax revenue over time, as it helps to stimulate the economy. However, in the immediate term, it may lead to a fall in takings. To make up for this, the government may have to raise other taxes, at least temporarily.

For example, they may increase National Insurance contributions again in order to raise more funds, as they did recently to address the social care crisis. Alternatively, they may freeze more tax allowances, so that rising wages and fiscal drag increase their net revenue.

This could mean that while your Income Tax falls, your wealth is being eroded in other ways. If you want to avoid this prospect, seeking professional advice can help to give you greater peace of mind.

When you work with a financial planner, they can help you to manage your wealth in a more effective way to minimise the impact that tax rises and allowance freezes could have on you.

This can give you a greater confidence that you’ll be able to grow your wealth over the long term and meet your financial goals.

Get in touch

If you’re concerned about the prospect of future tax rises and want to gain more peace of mind, get in touch. Please email enquiries@metiswealth.co.uk or call 0345 450 5670.

Please note:

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.