You might recall that Rachel Reeves confirmed in the 2025 Spring Statement that Income Tax thresholds will remain frozen until 2028. In fact, they have been frozen since March 2021.

While tax rates themselves might remain the same in the years to come, the thresholds at which these rates kick in have not recently been adjusted for inflation or wage growth. The subtle effects of frozen tax bands can be significant, and you might even find that they gradually erode your take-home pay.

This is a phenomenon known as “fiscal drag”, where a greater portion of your earnings becomes subject to Income Tax over time, even though rates haven’t risen.

Here’s what you need to know about how this works and what it could mean for your finances.

As your wages gradually increase, more of your earnings become subject to the Income Tax net

The amount of Income Tax you pay each tax year will depend on:

- How much of your income sits above your Personal Allowance

- How much of your income falls within each Income Tax band.

As of the 2025/26 tax year, your Personal Allowance is £12,570. This will be reduced by £1 for every £2 you earn above £100,000. This means that your Personal Allowance will be tapered down to zero if your income exceeds £125,140.

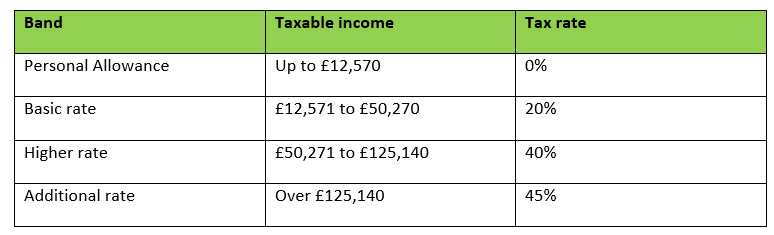

The current Income Tax rates and bands are as follows:

As an example, if your salary were to increase from £90,000 to £100,000 over a few years, the portion of your income taxed at the higher rate would grow. However, you would still only pay the basic rate of 20% and the higher rate of 40%, as your earnings would still fall under the additional-rate threshold.

If your salary were to increase from £100,000 to £130,000 after bonuses and commission, you would pay the additional rate on everything you earn above £125,140. Additionally, you would no longer have a Personal Allowance, meaning that your tax bill would likely rise even more.

While paying more tax is usually a natural consequence of earning more, the main problem arises when the thresholds remain static for extended periods.

If bands were to increase or adjust with inflation and wage growth, you’d find less of your salary falling into higher bands.

With a frozen Personal Allowance and Income Tax bands, the amount of your income taxed at the higher- and additional-rates will steadily increase.

This is fiscal drag in action.

Over time, frozen thresholds can lead to a noticeable reduction in your take-home pay

The effects of frozen tax bands might seem small in any single year, but the combined effect over several years can be significant.

As inflation pushes wages up, and as you progress in your career, a bigger portion of your income may become subject to Income Tax each year. This phenomenon will affect millions of taxpayers in the UK.

In fact, IFA Magazine reports that, by 2027/28, an estimated 12 million people may move into the higher-rate tax band, and a further 2 million will begin paying additional-rate Income Tax.

What’s more, 8.2 million of the total 17.9 million people likely to be pulled into paying some form of Income Tax are over the age of 60.

interactive investor further forecasts that high earners with an income of £100,000 could be as much as £2,445 worse off each year until April 2028.

This could have an impact on your ability to save, invest, or even maintain your current living standards.

4 techniques to consider to potentially mitigate the effects of fiscal drag

While you may not have direct control over government policies, there are several strategies you can explore to potentially mitigate the effects of frozen Income Tax bands on your personal finances.

1. Maximise your pension contributions

Contributions to your pension scheme can reduce your taxable income. So, by increasing your contributions, you could lower the amount of tax you pay while helping to grow your future wealth.

2. Use tax-efficient savings and investments

Products such as Individual Savings Accounts (ISAs) offer tax-efficient growth and withdrawals. By making use of these vehicles, you could shield a portion of your savings and investment gains from Income Tax. While this won’t directly reduce the amount of Income Tax you pay on your earnings, it can help to maximise your returns on savings and investments that could otherwise be taxable.

3. Consider salary sacrifice schemes

If offered by an employer, salary sacrifice schemes (such as those for pension contributions or electric vehicles) can reduce your taxable income. By sacrificing a portion of your salary in exchange for a non-cash benefit, you are effectively lowering the amount of your income that is subject to tax.

4. Seek professional guidance

A financial adviser can provide personalised guidance based on your specific circumstances. We can help you identify tax-efficient strategies and plan your finances in a way that aims to minimise the effects of frozen Income Tax bands over the long term.

Understanding the long-term implications of Income Tax is key to informed financial planning

Frozen Income Tax bands can represent a subtle but significant shift that has real consequences for taxpayers.

By understanding how these static thresholds interact with wage growth and inflation, you can become more aware of the gradual erosion of your disposable income.

While you can’t control the government’s implementation of tax policy, proactive financial planning can help to mitigate the effects of fiscal drag and offer you a more financially resilient future.

Staying informed and seeking professional advice are crucial steps to ensure your long-term financial stability and earning power.

This is something we can help you with.

Email enquiries@metiswealth.co.uk or call 0345 450 5670 today to find out what we can do for you.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

Workplace pensions are regulated by The Pension Regulator.