When a new tax year begins, there are often new rules and allowances to account for, and 2024/25 is no exception.

The chancellor has announced several changes to tax thresholds and rates that have now come into effect. One of these is the cut to the main rate of National Insurance, leading many to breathe a sigh of relief at the prospect of a lower Income Tax bill this year.

Even though Income Tax on your earnings may fall as a result of this cut, your overall tax bill could still rise in 2024/25. Frozen tax thresholds and allowances mean that, depending on your circumstances, you could be pulled into a higher tax band or face higher bills on other types of taxes this year.

Read on to learn more about how this could affect you this year and how a financial planner can help you to spend and save as tax-efficiently as possible in 2024/25.

The main rate of National Insurance has fallen for the second time in 12 months

In his 2023 Autumn Statement, chancellor Jeremy Hunt announced that the main rate of National Insurance would fall from 12% to 10% on earnings between £12,570 and £50,270.

Then, in the Spring Budget in March 2024, he announced a further cut. The main rate of National Insurance will fall a further two percentage points to 8%, and Class 4 National Insurance contributions will fall to 6%. Both of these changes take effect from 6 April 2024.

This is good news for those who earn a living through employment or self-employment. Indeed, the government reports that an employed individual with average earnings of £35,400 will save £900 a year in Income Tax as a result of these two cuts.

3 frozen tax thresholds that mean you could still pay more tax in 2024/25

Though the cuts to National Insurance are good news for millions of employed and self-employed people, they aren’t the only points from the recent budgets that will affect your taxes.

The government has also frozen – and in some cases reduced – a number of tax thresholds. This means that despite the National Insurance cuts, you might still pay more tax in 2024/25.

1. The government has frozen or reduced Income Tax bands

The government has frozen the thresholds for basic- and higher-rate Income Tax until 2028.

The thresholds will remain at:

- £12,570 for basic-rate Income Tax

- £50,270 for higher-rate Income Tax.

This means that, as your income increases over time, you could be pulled into a higher tax band, paying more Income Tax.

In addition to freezing the thresholds for paying basic- and higher-rate Income Tax, the government has reduced the threshold above which you pay additional-rate Income Tax.

Previously, you only had to pay additional rate Income Tax on earnings that exceeded £150,000. But as of April 2023, this has fallen to £125,140. This means that more high earners could fall into the highest Income Tax bracket. If you already earn £150,000 or more, this change has meant that you’ll pay additional-rate Income Tax on a larger proportion of your earnings than you would have done previously.

2. The Capital Gains Tax Annual Exempt Amount has fallen

Capital Gains Tax (CGT) may be payable on the profits you make from selling certain types of assets, including personal possessions worth more than £3,000 (excluding your car), property that isn’t your main residence, or investments that aren’t held in a tax-efficient wrapper.

Each year, you have an Annual Exempt Amount for CGT, so it is only payable on any profits that exceed this threshold. In 2024/25, the CGT Annual Exempt fell from £6,000 to £3,000 – or £1,500 for trustees. This means that you may need to pay CGT on a larger proportion of the profits you make from these types of sales.

3. The Dividend Allowance has fallen

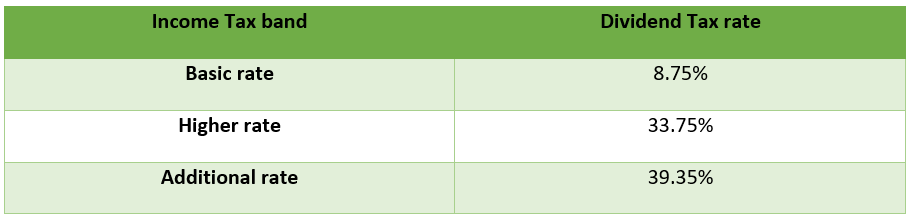

If you take an income from dividends, you may need to pay Dividend Tax if the income exceeds the Dividend Allowance in addition to your Personal Allowance.

In 2023/24, the Dividend Allowance was £1,000, but from 6 April 2024, this was halved to £500. The rate of tax that you pay will depend on your marginal rate of Income Tax:

Your financial planner can help you to spend and save tax-efficiently

As you can see, while the National Insurance cut could help to reduce the Income Tax you pay, you may still find that your overall tax bill rises over the course of 2024/25 and beyond.

When your tax bill rises, it can be more difficult to contribute to your pension or your investment portfolio, which could have implications for your long-term financial goals.

A financial planner can help to ensure you pay the correct amount of tax without sacrificing your progress towards these goals. They can offer advice about tax-efficient investments as well as the most sensible way to take an income that will allow you to use your wealth to create a lifestyle you love, both now and in the future.

If you’d like to learn more about how we can help you with these, please get in touch.

Email enquiries@metiswealth.co.uk or call 0345 450 5670 today to find out what we can do for you.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.