With headlines talking about market volatility, economic slowdowns, and geopolitical tensions, it’s only natural that investors are questioning whether they should stay the course or move to cash.

More than that, you might be wondering if further investing in the future is a viable choice.

However, history suggests that abandoning your investment strategy during market downturns can be detrimental to your long-term financial goals.

Investing successfully during uncertain times is more than possible, but it requires careful consideration.

Here are some key points to keep in mind if you are asking yourself: “Should I still invest?”

Balancing risk in your portfolio can offer a degree of stability in a volatile market

When economic seas become rough, certain sectors and industries tend to weather the storm better than others.

Here, it can help to look into investments that have a track record of performing consistently, even during market dips. One example of these is “defensive stocks”, which typically belong to industries that provide essential goods and services.

Examples include:

- Consumer staples such as food, beverages, and household products

- Utilities such as electricity, heating, and water

- Healthcare, such as pharmaceuticals and medical device manufacturing.

Regardless of the broader economic climate, people still need to eat, require medical care, and rely on electricity and water.

This constant demand translates to relatively stable earnings and growth for companies in these industries, making their stocks less prone to dramatic price swings.

Including a balance of risk in your portfolio could act as an anchor during periods of volatility, as it can provide a degree of stability and potentially cushion your portfolio against the overall effects of market instability.

As they tend to be stable, steady climbers, defensive stocks may not offer high-growth potential. However, it is this trait that makes them a valuable player for a resilient portfolio.

Remember, the value of any investment can go down as well as up. Although defensive stocks can be a helpful mainstay of an investment portfolio, there is usually an element of risk involved with any investment you make.

Diversity in your investments can help make your portfolio more stable

In the world of investing, diversification is a cornerstone of risk management. Simply put, a diverse portfolio is usually more stable; instead of putting all your eggs in one basket, owning a range of assets means that any downturns in certain areas could be offset by gains in another.

Bonds, which are a different asset class compared to stocks, can play a crucial role in achieving portfolio diversity. They can also be particularly useful during uncertain times.

Historically, stocks and bonds have a negative correlation. In other words, as stock markets decline, bond prices may rise, and vice versa.

This inverse relationship can help to offset equity losses in your portfolio.

More than that, certain types of bonds, such as high-quality government bonds, are often considered “safe-haven” assets. This is primarily because of their perceived low risk and stability, particularly during volatile markets.

Keep in mind that in times of economic uncertainty, investors might shift their investments from riskier assets, such as stocks, to safer options such as government bonds. This can drive up demand and potentially lower yields.

Remaining invested during challenging markets often results in higher long-term yields

Investing during market volatility can understandably feel nerve-wrecking, but historical data provides helpful insights and offers a new perspective.

Significant events, such as the 2008 financial crisis, the EU referendum, and the dot-com bubble, have all caused stock markets to underperform. If you held investments at these times, you may remember your portfolio falling in value. However, markets normally have a way of recovering.

You may be tempted to “time the market” in an attempt to miss its worst days while still benefiting from its best. However, history shows that the best days in the market tend to come immediately after the worst.

For example, JP Morgan notes that over the last 20 years, seven out of the 10 best days occurred within 15 days of the 10 worst days.

Timing your investments to benefit from market recovery can be tricky, and you might find that remaining invested instead could lead to more favourable results. A diverse portfolio is likely to weather any short-term storms and yield a healthy return over the long term.

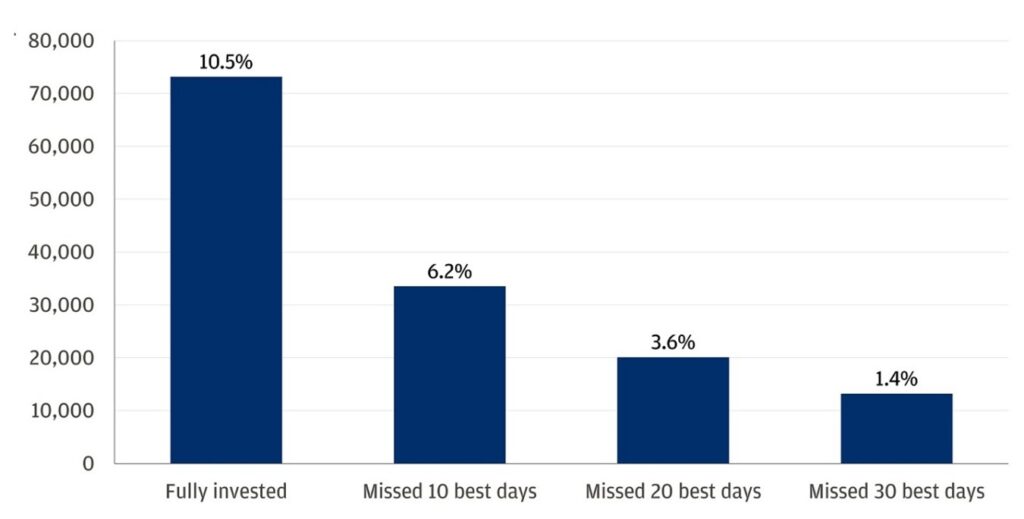

The graph below shows how a portfolio worth $10,000, invested in the S&P 500 between July 2004 and July 2024, would have grown if the investor had remained invested throughout the entire time.

It then compares this performance to if the investor had missed the best market days of the period due to selling and re-buying in an attempt to time the market.

Source: JP Morgan

As you can see, the more “best days” you miss, the more likely your portfolio is to underperform. In the worst-case scenario, your portfolio could even lose value over the long term due to your anxieties about stock market dips.

Let your adviser help you through market uncertainty

While it’s understandable that market uncertainty or volatility can be nerve-wrecking, acting on these emotions may not be productive.

Your adviser can help you navigate market volatility, shedding light on headlines and ensuring you’re making informed decisions for your portfolio.

Indeed, we can provide a rational perspective amid emotional market reactions and help you avoid impulsive decisions that could harm your long-term returns.

Get in touch

If you’d like to learn more about how we can help you manage your investments through good and bad times, talk to us today.

Email enquiries@metiswealth.co.uk or call 0345 450 5670 today to find out what we can do for you.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.