Inflation has been rising sharply across the globe since the middle of 2021. In the UK, it has risen from 0.4% in February 2021 to a high of 11.1% in October 2022, falling slightly to 10.1% in March 2023.

While rates have begun to fall in other countries – it was 3.3% in Spain and 6.9% in the eurozone in March 2023 – in the UK, inflation is still in double digits and continues to hover around a 40-year high. So why is inflation still so high, and when can you expect to see it start to fall? Read on to learn more.

A combination of factors has driven inflation to record highs

Prices first began to rise following the relaxation of many Covid rules and guidelines.

When lockdowns were lifted, demand for goods and services increased. But the lockdowns had caused a lot of manufacturing plants to close too, so they couldn’t keep up with the sudden increase in demand. Some factories in other countries were still under lockdown restrictions when this demand increased.

As a result, there was a shortage of many of the things people were buying, which led to an increase in prices.

In 2022, inflation was driven higher still by a rapid increase in energy prices. This was caused by Russia withdrawing its supply of natural gas to western Europe during its invasion of Ukraine, which has had a knock-on effect on the cost of electricity and petrol.

Additionally, food costs have risen, partly because of the conflict in Ukraine. Russia and Ukraine are both significant exporters of products such as wheat, vegetable oil, and some metals. The reduced availability of these goods has led to a large increase in their price.

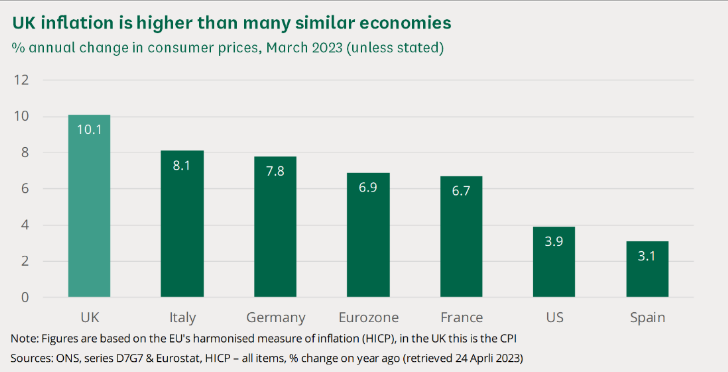

Britain continues to experience much higher rates of inflation than neighbouring European countries

Even though inflation has begun to fall since Q4 2022, the UK continues to experience the highest rate of price rises in western Europe, as shown in the graph below.

Source: House of Commons library

So why has inflation stayed so high here when other countries are seeing much bigger drops?

According to a report from Reuters, there are a few possible reasons for this:

- The UK relies more heavily on natural gas for energy production than other countries, meaning that the increase in prices of natural gas is passed on to consumers paying for electricity.

- While most countries are offering state subsidies to support citizens with the increased costs of energy, the way these support packages are structured differs. This has meant that UK prices remain higher than elsewhere.

- The UK is also experiencing significant labour shortages. This is partly a result of many people deciding not to return to work after the pandemic ended, taking early retirement, indefinite sick leave or simply becoming economically inactive. This hasn’t been the case for many European countries.

The Guardian has reported that some of the factors driving the UK’s high inflation rates may have been exacerbated by Brexit. Stricter migration rules, longer delivery times for EU goods, and higher costs of importing could all have played a role alongside the abovementioned points.

The Bank of England expects inflation to fall sharply throughout 2023

The good news is that inflation has started to fall. The Bank of England (BoE) considers that inflation may have already peaked at 11.1% in October 2022 and expects it to fall sharply throughout 2023.

While not all the causes of inflation are likely to disappear in the near future, some of the factors will soon cool.

Energy prices, for one thing, have begun to fall, leading to the slight drop in inflation since the start of 2023.

As well as this, the BoE has taken action to reduce inflation back to its 2% target by raising interest rates. The Monetary Policy Committee has increased the base rate 12 times since December 2021, meaning it’s risen from 0.1% to 4.5% in May 2023.

Interest rate rises are designed to make it more expensive to borrow money and to encourage people who are able to, to save money rather than spend it. This usually reduces demand for goods and services, lowering the prices and subsequently bringing inflation down.

Interest rate rises take time to have their full effect though. So far, even though inflation has fallen, the decrease has been slow. This means that it could take a lot longer for the changes the BoE has made to have their full effect.

High inflation can erode the buying power of your wealth

The nature of inflation means that the money you have today won’t stretch quite so far in a year’s time, as goods and services rise in value. At times of high inflation, this can pose a challenge if you’re saving for retirement or are already taking an income from your pension and want the growth of your money to keep pace with inflation.

Investing in the stock market can give your money more opportunities to grow as a result of compound returns. This means it stands a better chance of keeping up with inflation than if you were to keep the same amount of money in an easy access savings account, as the interest rate is usually lower on these types of accounts. However, investing does carry risk and you could get back less than you originally invested.

Get in touch

Inflation will affect everyone differently. If you’re concerned about how inflation could affect your wealth, we can help you to decide on the most appropriate steps to take to protect your wealth.

Email enquiries@metiswealth.co.uk or call 0345 450 5670 today to find out what we can do for you.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.