Premium Bonds are one of the most popular ways to save in the UK. In fact, MoneySavingExpert reports that more than 22 million people have invested a total of over £120 billion in them.

Since the beginning of 2023, though, Premium Bonds have become even more attractive because National Savings & Investments (NS&I) has increased the number of prizes on offer twice. This has brought the prize fund rate to 3.3% – matching some of the top easy access savings account rates.

So, with the recent increases to the prize fund rate and with so many people already invested, are Premium Bonds worth considering as a way to hold cash this year? Read on to learn more.

Premium Bonds are a secure way to save cash

Premium Bonds are similar to an easy access savings account in that you can deposit and withdraw money whenever you’d like to. The key difference is that, rather than having an interest rate that allows your cash to generate returns, the bonds you own are entered into a prize draw every month.

The minimum deposit you can make is £25, while the maximum amount you can hold is £50,000. For every £1 you invest, you buy one bond. So, the more bonds you hold, the more entries you have in the draw, giving you a greater chance of winning.

The money you invest in Premium Bonds is protected by the Treasury so you can’t lose any money. An added incentive to enter the draw is that any prizes you win are tax-free.

There is the opportunity to win large prizes

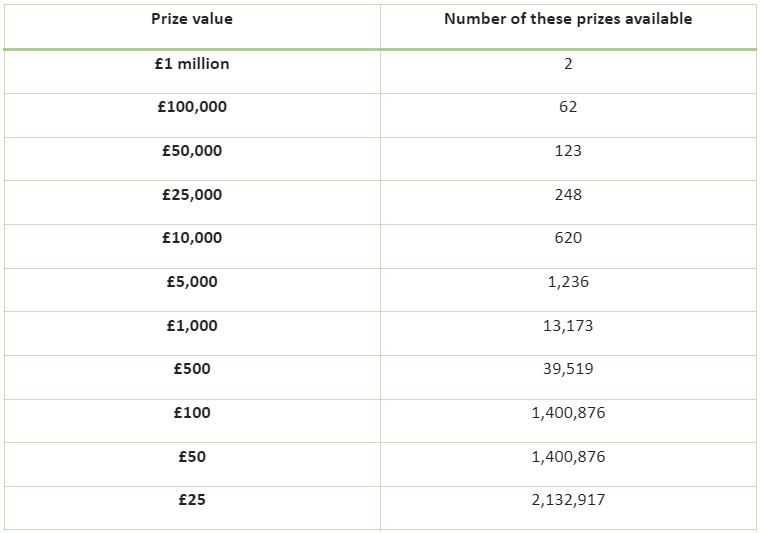

The prizes on offer range in value from £25 to £1 million. While the distribution changes slightly from month to month, as you can see below, lower-value prizes make up a much larger proportion of the pot.

Source: NS&I

The average prize fund rate is 3.3%, but since the smallest prize you can win is £25, you could achieve a return higher than this if your bond numbers are picked.

Say you have £500 saved in your pot and you win the smallest prize. This equates to a return of 5%. This would mean that you’ve generated higher returns than you would have done on the same amount if you’d saved it in a cash savings account that offers 3.3% interest.

So, even though the prizes aren’t guaranteed, there is the potential to win big.

The prize fund rate is an average, so most bond holders will never win a prize

In reality, the probability of winning even a small prize, let alone the £1 million prize, is very slim for most people who have invested in Premium Bonds.

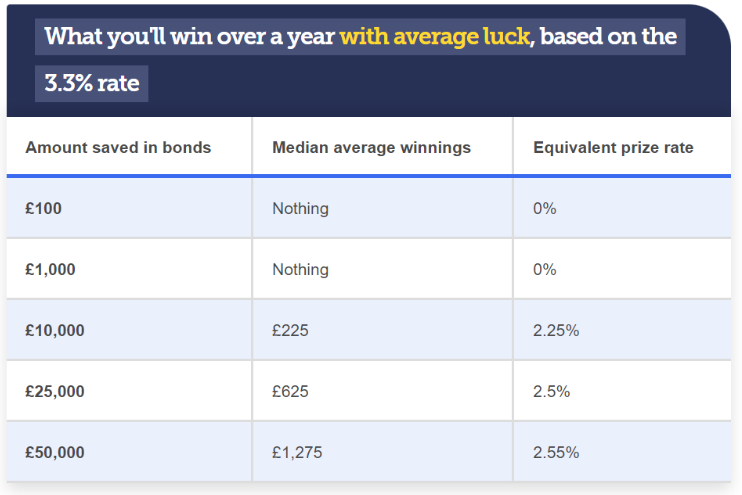

MoneySavingExpert has calculated that, over the course of a year, most people won’t win anything on Premium Bonds.

Source: MoneySavingExpert

As you can see, the people who own more than £10,000 worth of bonds have a much greater chance of winning than those who hold £1,000 or less. But even they are unlikely to secure the 3.3% returns that are theoretically possible.

So, while Premium Bonds can be an exciting way to save, there is a good chance that you could go many years without winning anything.

Interest on cash savings accounts is more reliable

By comparison, easy access savings accounts could offer a similar rate of interest to the prize fund rate – according to MoneySupermarket the highest available interest rate as of 20 March is 3.4% – alongside many of the benefits that Premium Bonds also offer.

While Premium Bonds offer top-tier security for your money, as they are protected by the Treasury, most high street banks are covered by the Financial Services Compensation Scheme (FSCS). This means that, in the event of the bank or provider failing, you will receive all of your money back up to the value of £85,000.

Another benefit of saving with Premium Bonds is tax efficiency, because any prizes you win are tax-free. But since the introduction of the Personal Savings Allowance (PSA), you can earn up to £1,000 in interest tax-free each tax year if you are a basic-rate taxpayer. For higher-rate taxpayers, the PSA is £500 each tax year.

It’s also possible to deposit up to £20,000 a year in a Cash or Stocks and Shares ISA, with any interest or returns generated being free from Income Tax.

So, unless you have already used up your PSA and your ISA Allowance for the year, there aren’t any additional tax benefits to using Premium Bonds over a cash savings account.

Get in touch

Ultimately, the only way to know whether Premium Bonds are the right choice for you is to consider your own personal circumstances and goals.

If you’d like help deciding how best to grow your wealth so that you can achieve your goals, we can help. Email enquiries@metiswealth.co.uk or call 0345 450 5670 today to find out what we can do for you.

Please note

The Financial Conduct Authority does not regulate NS&I products.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.