The rising cost of living has been one of the top financial stories of the past two years and has affected fiscal policy both here in the UK and around the world.

The good news is that the Office for National Statistics has reported that inflation dropped to the Bank of England’s (BoE) target of 2% in May, and remained at this level in June, after peaking at 11.1% in October 2022. But what could happen next, and what might this mean for the economy as a whole? Read on to find out.

Inflation has fallen from its peak in fits and starts

According to information shared by the House of Commons, inflation began to rise in the UK in 2021 as a result of several factors, including:

- A shortage of goods and services after demand soared following the relaxation of Covid lockdowns

- The increase in gas and energy prices following the Russian invasion of Ukraine in 2022

- The rise in food prices as a result of supply chain disruption across the world.

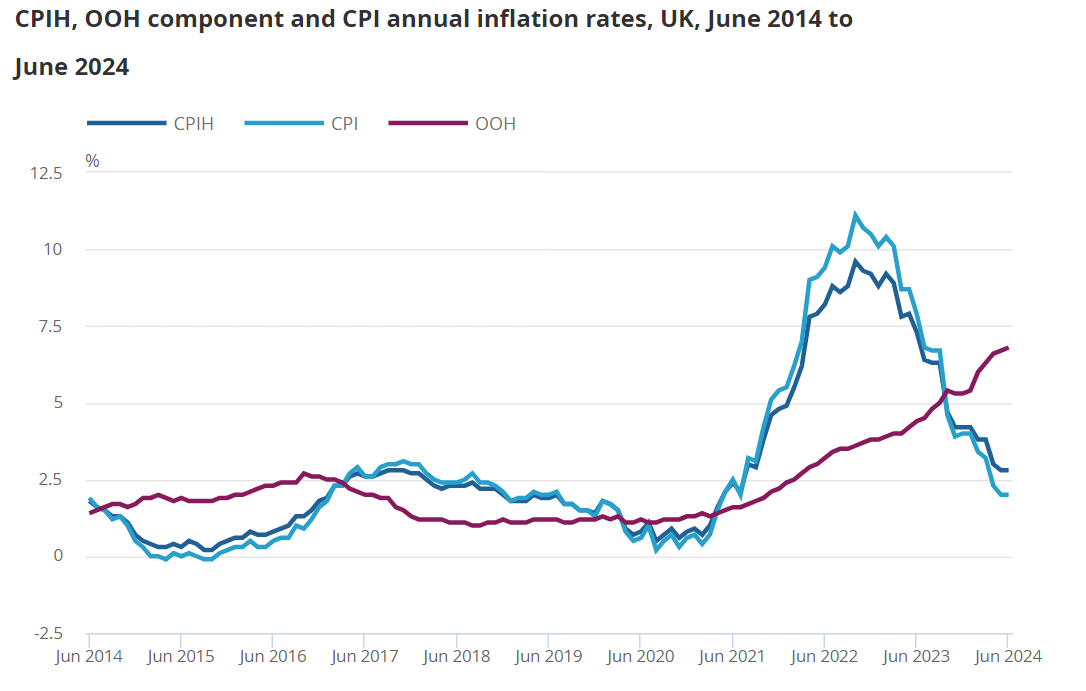

Inflation as measured by the Consumer Prices Index (CPI) peaked at 11.1% in October 2022, its highest rate in 41 years, before beginning to fall again. Since then, despite occasional months in which inflation remained flat or rose again slightly, it has steadily fallen back to 2% in May 2024, remaining at this level in June, as shown in the graph below.

Source: Office for National Statistics

The Bank of England expects inflation to stay around 2% for the rest of 2024

The circumstances that led to the rapidly rising prices have eased and, as of May 2024, inflation has fallen back to 2%, which is the target that the government sets the BoE. This means that prices are continuing to rise, but at a more manageable rate.

It’s impossible to predict exactly what will happen next to inflation, but the BoE has reported that it expects inflation to remain around 2% for the rest of the year. It’s possible that it may rise briefly to 2.5% before settling back to 2%.

Falling inflation can have a positive effect on the economy

The first half of 2024 has seen the UK economy outperform expectations after recovering from a brief recession at the end of 2023. Now, the drop in inflation is more good news.

When inflation is at its optimum level of 2%, it can have the following effects.

Interest rates may start to fall

Now that inflation has returned to its 2% target, the BoE can begin to consider cutting its base rate, which has been held at 5.25% since August 2023. In turn, this means that banks and lenders may be able to cut interest rates. High interest rates are one of the tools the BoE uses to help reduce inflation when it rises too quickly. So, provided inflation remains steady, rates may begin to fall soon.

Reuters reports that the BoE could begin cutting rates as early as August or September.

Lower inflation and interest rates mean consumers may start to spend more

When interest rates fall, it can encourage consumers to spend more, as borrowing is less expensive. This can help businesses in a range of consumer-facing sectors to thrive and, as a result, the economy can grow.

The fall in inflation has already coincided with strong economic performance in the UK. Reuters reports that Gross Domestic Product (GDP) grew by 0.7% in Q1 of this year, ahead of the 0.6% growth that had been predicted. This is especially good news considering the brief recession that occurred at the end of 2023.

The stock market may react positively to falling inflation

According to IG, lower inflation may also lead to higher returns on the stock market. When consumers have more spending power, demand for shares usually increases, in turn pushing up share prices.

This can be seen in the slow but steady growth of the FTSE 100 in the first half of 2024, as shown on the graph below.

Source: London Stock Exchange. Date range: 1 January – 30 June 2024

Additionally, J P Morgan reports that the FTSE All-Share rose by 3.7% in Q2, and 7.4% for the year to date.

Get in touch

If you’d like to learn how we can help you manage your wealth as inflation falls so that you can achieve your long-term goals, please get in touch. Email enquiries@metiswealth.co.uk or call 0345 450 5670 today to find out what we can do for you.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.