Last month, Labour secured a historic victory in the general election after 14 years of Conservative leadership.

A change in government can create uncertainty, which is notoriously worrying for investors as stock markets may become unpredictable. But the Labour win seems to have done the opposite, and instead led to stability and positive returns on domestic and international markets.

Read on to learn more about how stock markets have reacted to the election outcome and what this could mean for your investments.

The Labour win led to positive returns on UK and European stock markets

The reaction on UK stock markets was muted yet positive on the day of the election win. Reuters reports that the FTSE 250 rose by 1.8% in early trading on 5 July, taking the index to its highest level since April 2022. The FTSE 100 rose by 0.2% that day, and 10-year British government bond or gilt yields fell three basis points to 4.17%.

In particular, the construction sector performed well. Reuters reported that an index tracking British home builder shares rose by 2.3%. This may be because new housebuilding targets featured heavily in the party’s manifesto pledges, so a Labour government may create growth in this sector over the coming years.

Further afield, European markets also rose slightly after the win was announced. Sky News reports that the pan-European STOXX 600 index grew by 0.4%.

Sterling, which has risen in value since Rishi Sunak called the election, increased by 0.13% against the dollar to $1.2775, according to the Reuters report. Its value against the euro remained stable.

The Labour win was widely expected, which may be why stock markets reacted positively

Though elections can create uncertainty on stock markets, the Labour win was widely anticipated in the polls. Moreover, as votes were counted, it quickly became clear that the party had secured a landslide victory. The Reuters report shared that this may have contributed to the positive reaction from UK and European stock markets, as it indicates stability and clarity.

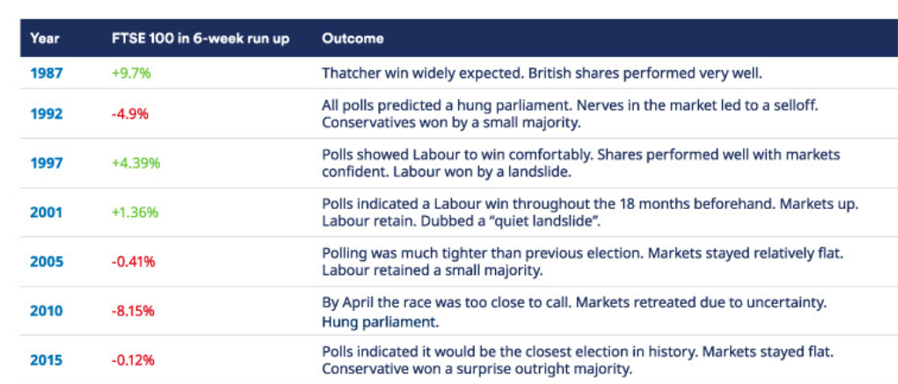

This is not unusual. Historical data demonstrates that elections in which a particular outcome is anticipated ahead of time tend to have a positive effect on stock markets. The table below shows how the FTSE 100 performed in the six weeks prior to UK general elections since 1987.

Source: Schroders

As you can see, if an outcome was easy to predict, the election tended to have a positive effect on the index. Meanwhile, if polls were mixed, the FTSE usually declined.

What’s interesting to note is that, after an election outcome is announced, history suggests that stock markets will continue to perform as they had done before the election was announced. This is often the case regardless of how markets have performed throughout the campaign.

For example, IG reports that markets had been in decline prior to the 2001 election. Performance picked up during the election as a Labour win was widely expected, but shortly after the win was announced markets went back into decline.

Similarly, in 2010 markets had been performing well, but declined during the election cycle since there was no clear winner indicated by the polls. A hung parliament was confirmed after the vote, extending the uncertainty and the market decline. After the coalition government was announced, however, markets recovered and continued to grow.

A whole range of factors can affect market performance, so it’s sensible to take a long-term view

While the trends that markets have followed during and after previous general elections can provide helpful data, remember that past performance does not guarantee future performance.

In fact, there are countless different factors that can influence market returns at any given time. Even though there are many years of data to suggest what might happen next, it really is impossible to predict with certainty.

As such, it’s usually sensible to take a long-term view of your investments, rather than to worry too much about how one-off events like a general election might affect your portfolio. The fluctuations in value that world events can create are part and parcel of investing in the stock market. Over time, a carefully balanced portfolio can usually weather short-term volatility before continuing to grow.

Get in touch

To learn more about how we can help you to grow your wealth regardless of how world events affect the stock markets, please get in touch.

Email enquiries@metiswealth.co.uk or call 0345 450 5670 today to find out what we can do for you.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.