At the end of October and beginning of November, two significant political events took place on either side of the pond: the new Labour government announced its first Budget on 30 October, and on 5 November the US election took place, with Donald Trump securing a second term in the White House.

Both of these events were highly anticipated, particularly as they were sure to have ramifications for the economy and stock markets in the UK and across the globe. So, now that both have happened and the future is more certain, how have markets responded, and what could the developments mean for your investments? Read on to find out.

Markets seemed relieved that Budget changes were less severe than anticipated

In the lead-up to the Budget, prime minister Keir Starmer and chancellor Rachel Reeves had intimated that the changes announced would be “painful”. Fortunately, the chancellor’s proposed changes weren’t all as severe as some had predicted, though businesses and wealthier individuals were generally hit hardest. This meant the market response was somewhat muted.

Sky News reports that the FTSE 100 fell by 0.7% on the day of the Budget, but AJ Bell reports that the chancellor’s investment plans caused the pound to strengthen against the dollar. Moreover, the housing and banking sectors of the stock market received a boost as investors seemed encouraged by the forthcoming end of the freeze on Income Tax and National Insurance thresholds in 2028.

The AJ Bell report also stated that businesses may find that their costs rise considerably as a result of the changes to employer National Insurance and the increase to the National Minimum Wage. It’s possible that these costs may be passed on to the end consumer.

The government reports that the changes announced in the Budget will likely add 0.2 to 0.4% to inflation by the end of 2027. Despite this, inflation is still forecast to be below the target rate of 2% by that point. Moreover, the Bank of England was able to cut interest rates by 0.25% at its November meeting as a result of inflation remaining at a sustainable rate.

Falling interest rates often lead to increased stock market returns, as consumers have more disposable income to invest. What’s more, companies are usually able to borrow at a more affordable rate, meaning they are better able to invest in growth, delivering greater returns for investors.

Trump’s decisive victory in the US election led to positive stock market returns in November

Donald Trump’s decisive victory removed the uncertainty that had weighed on US markets prior to the election. His economic policies include bringing inflation down to a manageable level, implementing tariffs on imported goods, and reducing immigration.

Trump’s track record of reducing taxes for businesses seemed to provide a boost to US stock markets when he was elected. Fidelity reports that the S&P 500 jumped by 2.5% and the Russell 2000 index rose by almost 6% when the result was announced.

J P Morgan reports that, across the month of November, US equities outperformed other regions. Meanwhile, the prospect of higher tariffs on imported goods that Trump has suggested as a policy weighed on stock markets across the world. The MSCI Europe ex-UK fell by -0.1%, partly as a result of concerns about US trade policy.

These political events are unlikely to have a long-term impact on stock market returns

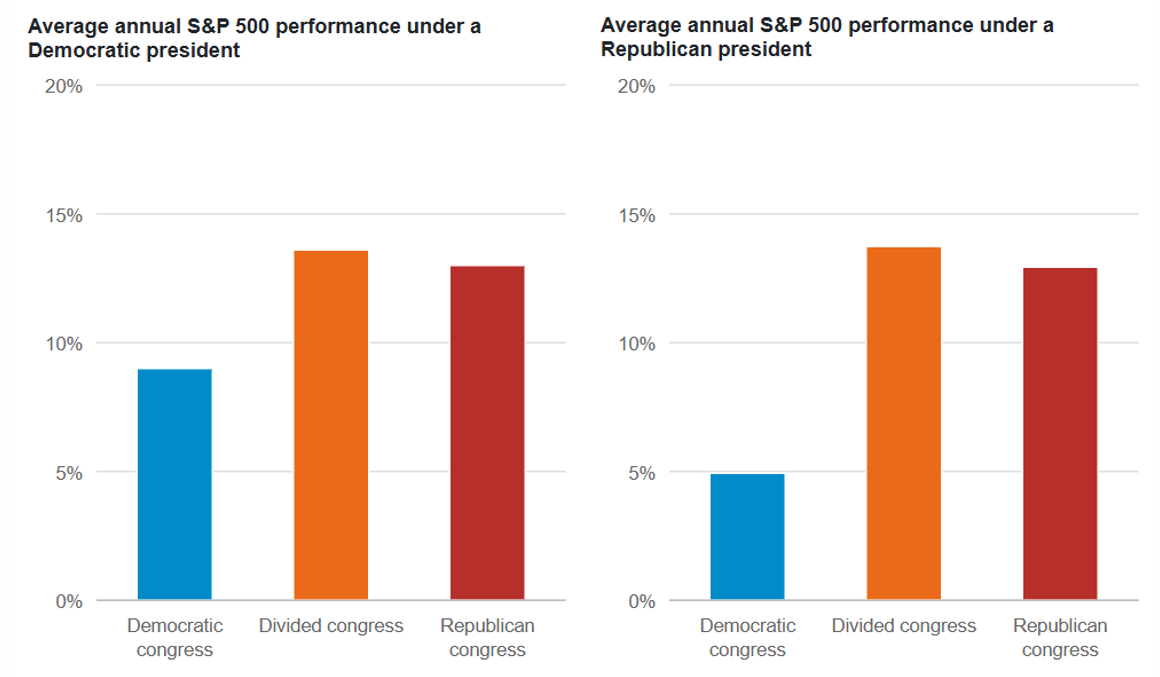

Despite these early responses to the US election, the Fidelity report shares historical data suggesting that stock market returns are unlikely to be influenced by who is sitting in the White House for very long. The graphs below show that returns tend to be similar whether the US has a Democratic or Republican president, based on data from as far back as 1933.

Source: Fidelity

Similarly, the Sky News report states that, despite the initial drop on the UK stock market following the Budget, many of the changes to tax legislation that were announced had already been priced in. So, these announcements are unlikely to have a long-term effect on market returns.

As such, it’s sensible to try and tune out the noise of the headlines when you make your investing decisions. Instead of basing your choices on how markets may or may not react to these political developments, focus on your long-term goals and the investment choices that have the potential to help you achieve these over the course of years or decades.

Get in touch

If you’re concerned about how world events or changes to tax legislation could affect your investments, please get in touch. Email enquiries@metiswealth.co.uk or call 0345 450 5670 today to find out what we can do for you.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.