In recent months, many businesses have encouraged customers to use contactless payments, as this can help reduce the spread of the coronavirus through surface contact. As a result, you may have noticed that far fewer people carry cash.

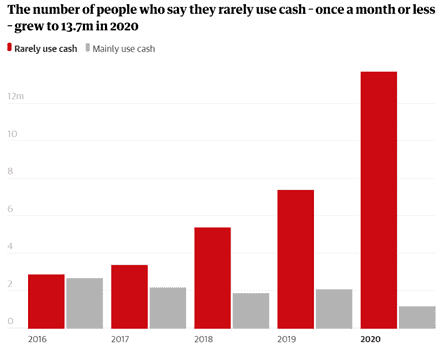

According to figures published in the Guardian, 13.7 million Brits now live a “cashless life” by relying on their credit or debit cards for all purchases. This is almost double the number who did so prior to the pandemic.

This shift has made many people wonder if the pandemic is hastening the end of cash in our economy. Read on to find out whether this is true and how it might affect you.

The use of cash has fallen sharply in recent years

In recent years, there has been a significant increase in the number of people using debit or credit cards to pay for things. The reason for this is fairly obvious too, as it’s much faster and easier to simply tap a card instead of trying to count out exact change.

As you may remember, at the start of the pandemic, the government raised the cap on contactless payments from £30 to £45. This was due to fears that the virus could easily spread through surface contact on notes and coins.

In October 2021, this limit was raised again to £100, making it much easier to use your card for larger payments. However, while this is likely to increase usage of credit and debit cards, the change is only part of a larger trend.

Source: The Guardian

In recent years, the use of cash has been declining in the UK as many shops transition towards contactless payments. According to a study published by the Guardian, by 2024 only 7% of shop payments are expected to be in cash.

While a credit or debit card is much faster and easier to use, another factor causing this trend is that many bank branches have closed in recent years. According to figures published in the Guardian, the number of bank branches has almost halved since 2015.

This means that even when people want to use cash, it can be much harder to as there is nowhere to access it.

Older people may be affected the most by this change

For many people and businesses, the move towards contactless payments has made things faster and easier. However, there are also many millions of people for whom the change may pose a problem.

One of the biggest groups that could be affected are the elderly, who are more likely to prefer using cash for their day-to-day spending. According to figures from Age UK, 2.4 million older people use physical money for almost all of their transactions.

This is why the move towards a cashless society has alarmed many people, as they are potentially at risk of being left behind by the new digital economy. Other groups who may be impacted by the shift away from cash include:

Service workers

If you have loved ones who work in the service industry, you may know how important tips can be to supplement their wages. These are typically made in cash, meaning that tipping may become less common if more businesses move towards using digital payments only.

Small business owners

The move to contactless payments could make the lives of small traders more difficult than they already are. Not only do they have to compete with online retailers, such as Amazon, but they may also have to pay additional fees to process digital payments, which would eat into their profits.

Charities

Since many charities rely on cash donations to pay for their good works, the move towards digital payments may mean they see a fall in their income. This would obviously mean that they wouldn’t be able to help as many people, as they don’t have the funds to do so.

It’s likely that cash payments will remain an option, even if they aren’t used as much

While it’s easy to be concerned about the declining use of cash, it seems likely that it will remain around in some form. While contactless payments may be much more convenient, physical money can have a lot of utility and so it will probably continue to be an option.

Even though some businesses have stopped accepting cash payments in recent months due to the pandemic, now that life is beginning to return to normal, it’s likely that many will change back.

Cash has a variety of advantages over digital payments and is much more familiar to older people. This is why, for now at least, it’s unlikely that it will disappear completely.

Get in touch

If you want to stay informed about changes in the economy, we can help. Please email enquiries@metiswealth.co.uk or call 0345 450 5670.