It’s not often that UK equities take centre stage, yet so far in 2024 the FTSE 100 has delivered much higher returns than the index is typically known for.

You may have seen the headlines that the FTSE 100 has achieved a new record high in recent weeks. This has led many investors to turn their attention back to the frequently overlooked UK stock market, wondering if now may be a good time to buy more shares.

However, despite the record growth, it may be sensible to hold back from investing more into the index.

The FTSE 100 grew more in Q1 this year than it did in the whole of 2023, reaching a new record high

So far in 2024, the FTSE 100 has delivered impressive returns. On 3 May, Reuters reports that the FTSE 100 achieved a new record high of 8,213.49. And interactive investor reports that, as of 9 May 2024, the index had risen by 8%, compared to 3.8% for the whole year in 2023.

According to interactive investor, this year’s gains have been mostly driven by overperformance in the aerospace and defence sector, as well as the mining sector and financial services.

Despite this growth, the index continues to lag behind international peers

While the growth of the FTSE 100 is certainly good news for investors, it’s important to put the growth in context.

For instance, J. P. Morgan reports that, as of 1 May 2024, the Japan TOPIX has risen by 17.1% and the MSCI Europe ex-UK has risen by 8%. According to the Guardian, in the time it took the FTSE 100 to exceed its previous record high from February 2023, the S&P 500 has returned 22% for investors.

So, while the growth seen so far is excellent news for the FTSE, it has not exceeded many similar indexes from around the world.

Media headlines can make stock market gains sound more impressive than they really are

It’s easy to become caught up in the hype surrounding stock market growth. All investors want to know that they have made sensible decisions with their money, so when an index or stock outperforms, the media will often amplify this in order to capture readers’ attention.

This is why it’s important to be selective about the news outlets you use and think critically about the stories you are reading. Remember, it’s the long-term potential of your investments that are more likely to affect your ability to achieve your goals than short-term fluctuations like these.

So, it’s important not to make any changes to your portfolio based purely on information from the media – instead, keep your long-term goals in mind, and ensure any changes you make are aligned with them.

It’s important to diversify your investments across multiple locations or sectors

As well as being selective about the media that you consume, the FTSE 100 performance so far this year is also a helpful reminder of the importance of diversification.

There’s no way to know which index or fund is likely to outperform or underperform in any given year.

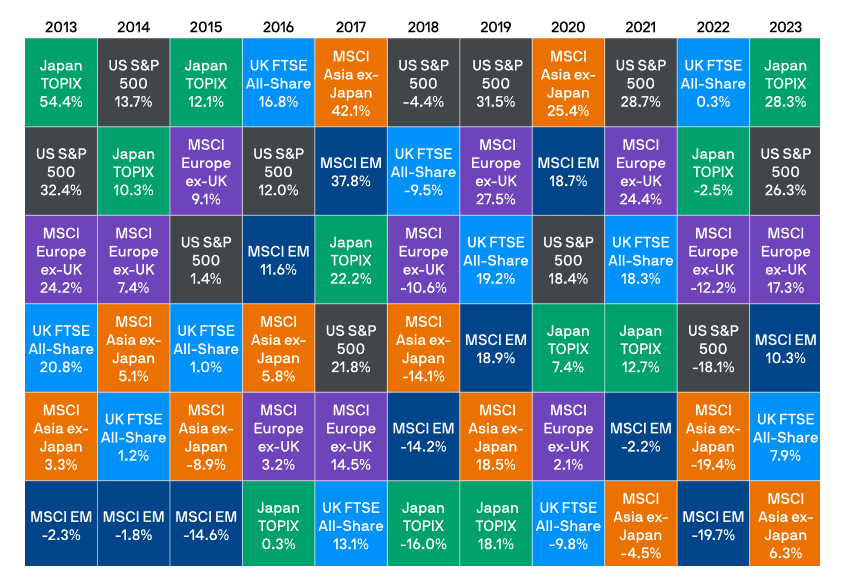

Moreover, none of the stock markets or indices around the world have consistently outperformed others – as you can see from the asset quilt below. Even if an index delivers outstanding results for one year, there’s no guarantee those returns will continue the following year.

Source: J. P. Morgan

In the asset quilt above, you can see that in 2020, the MSCI Asia ex-Japan delivered exceptional returns of 25.4%. If you had considered this to be an indicator of future success and invested more heavily in this index, you might have been disappointed the following year, when it fell by 4.5%, and again, by 19.4% in 2022.

But, if you had spread your investments equally across a range of indexes, another may have unexpectedly outperformed in the following year, mitigating any losses you may have experienced on the investments in the MSCI Asia ex-Japan.

This is why it’s so important to remember that past performance does not guarantee future performance. Just because an index is doing well this year doesn’t mean it will continue to deliver high returns in the future.

Diversifying your investments means you could benefit from outperformance while also mitigating the risk that some of your investments could underperform. Over time, this could give you a greater opportunity to grow your overall wealth and achieve your financial goals.

Get in touch

If you’d like to learn more about how we can help you to build an investment portfolio that helps you to achieve your long-term goals while also aligning with your personal attitude to risk, please get in touch.

Email enquiries@metiswealth.co.uk or call 0345 450 5670 today to find out what we can do for you.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.