For many investors in the global stock market, 2025 has so far been a year of volatility.

At times, you may have doubted whether your investment plans would come to fruition. For example, Trump’s April announcements triggered a particularly jarring slump in stock prices, with fluctuations still ongoing at the time of writing.

At home, the Office of National Statistics (ONS) reports that UK inflation hit an 18-month high of 3.8% in the 12 months to July 2025, and remained at this level in August 2025. Additionally, the government’s highly anticipated Autumn Budget is due to be delivered on 26 November 2025. So, it may seem unlikely that the stock market will see calmer waters any time soon.

In a climate such as this, you might be asking: “What should I do?”. You may even be wondering whether it’s time to cut your losses and exit the stock market before values drop.

A wise course of action could, in fact, be to do absolutely nothing.

Read on to learn how staying the course through stock market changes could deliver greater returns in the long term, and how to keep your knee-jerk reactions in check.

Historically, markets have always rebounded

Stock markets are, by nature, unpredictable. However, for decades, they’ve proven to be consistent in one area: their ability to recover.

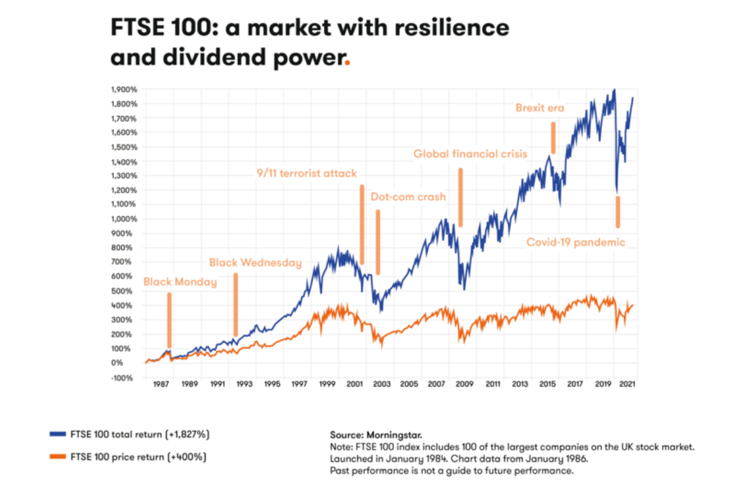

From 1987’s Black Monday crash to the Covid-19 pandemic, time and again the markets have rebounded from even the most significant downturns. In fact, share prices have generally gone on to reach higher levels after a downswing.

Since the FTSE 100 – an index of the 100 largest companies listed on the London Stock Exchange – was first launched in 1984, it has continued to trend upwards over time. As demonstrated in the graph below, instances of sudden downturns were consistently followed by a rapid recovery, resulting in steady long-term growth.

Source: interactive investor

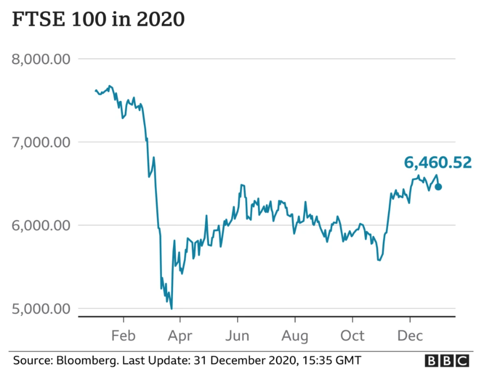

So, while it’s easy to be panicked by reports of sudden downturns, it’s important to step back and consider this bigger picture before acting. When viewed in isolation, dips in share prices can feel deeply concerning – such as in 2020, when BBC News reported on the FTSE 100’s “worst year since the height of the financial crisis”.

Source: BBC News

Without the context provided by decades of data, you’d be forgiven for thinking that 2020 was a disastrous year for investors. But long-term investors who stayed the course are now likely to have seen their share values recover and grow: as the graph on the London Stock Exchange website shows as of 2 September 2025, the index now exceeds pre-pandemic levels.

Around the world, markets generally follow the same pattern displayed above. After sudden downswings, indices typically recover and exceed their previous highs.

Selling during a downturn could mean opting out of market recovery

While your instinctive reaction may be to quickly offload your shares when values start to drop, this approach of “cutting your losses” guarantees you one thing: a loss.

This knee-jerk reaction, while common, can often result in investors missing out on the benefits of market recovery. If you give in to worry, you may not only lose a large portion of the money you originally invested, but you also risk losing out on returns further down the line.

Markets are undeniably unpredictable, and there are no guarantees that future recoveries will follow past trends. Yet, over the last 40 years, long-term investors who stayed the course through market downturns are likely to have benefited from a higher chance of positive returns.

Build a plan to weather inevitable market storms

From your very first investment, it’s often worth creating a detailed plan that includes your goals, time in the market, and a strategy for managing your portfolio when markets prove turbulent.

Generally, a solid investment strategy shouldn’t require you to react quickly or predict market trends. Instead, it should allow you to trust the plan, remain calm through downturns, and stay the course.

Plan for longevity

As the adage goes, “time in the market beats timing the market”. By building your plan for longevity, with the intention to retain shares over several years – or even decades – you could increase your chances of benefiting from long-term market growth and minimise the impacts of temporary downturns.

Diversify your portfolio

A strong investment strategy usually also includes a diverse portfolio, covering a range of asset classes and geographical regions. At any given time, a well-diversified portfolio is likely to always contain at least one type of asset that temporarily doesn’t perform as well as others. But by spreading your investments across multiple assets, you could help limit the impact of such volatility on your entire portfolio.

Define when to act

Additionally, you might choose to include a strategy for reacting to market fluctuations – such as when to rebalance your portfolio. By clearly defining when to act and when to stay the course, you can reduce the likelihood of making impulsive decisions.

Once your plan is in place, you may only need to do one thing – stick to it.

Act on strategy, not on emotion

By following these steps, you could avoid making any rash decisions, and help ensure you act strategically rather than emotionally.

1. Stop and take a breath: Giving yourself time to process the situation and consider the bigger picture can help avoid impulsive decisions.

2. Shut out the noise: Taking yourself away from the news, social media, and any other online sources could reduce any feelings of panic.

3. Check your plan: Revisiting your goals and strategy can be a valuable reminder to trust your long-term strategy.

4. Consult with a financial planner: Speaking with an independent adviser can provide valuable guidance, reassurance, and help in defining your next steps.

Of course, there may be instances where a change of plan is necessary – such as if unexpected personal events affect your financial circumstances. If this happens, it’s often sensible to confer with a financial planner to ensure you’re making the right decisions for your situation.

Get in touch

At Metis Wealth, our financial planners can help you define a long-term investment plan tailored to your personal circumstances, risk appetite, and goals. By staying on hand to support you, we can help you evaluate your portfolio and determine whether a change of course is needed.

Contact us by emailing enquiries@metiswealth.co.uk or calling 0345 450 5670 to find out what we can do for you.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.