It’s been hard to keep track of all the changes made to taxes and government spending plans as 2022 saw four different chancellors of the Exchequer.

In light of all the back and forth, you might be glad to have a quick summary of the new measures that will be coming into force soon. Read on for nine tax changes starting in April and how they could affect you.

1. Freeze on the Personal Allowance and basic- and higher-rate tax thresholds

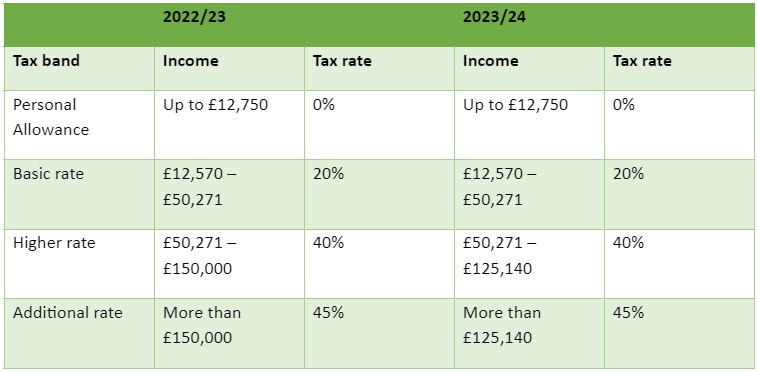

Income Tax at all levels has been frequently discussed throughout 2022 but in his autumn statement, Jeremy Hunt confirmed the measures that will take place in the tax year 2023/24.

The first announcement is a freeze on the Personal Allowance until 2028, meaning that the amount of income you can earn before you pay Income Tax will remain at £12,570.

The thresholds for paying basic- and higher-rate tax have also been frozen until 2028, an extension of the previous freeze that was due to be lifted in 2025/26.

While the freezes don’t increase the tax you pay immediately, if your salary increases during that time, it could push you into a higher tax bracket.

2. Reduction of threshold for additional-rate Income Tax

A further change to Income Tax rules for the new tax year is a reduction of the additional-rate threshold in England.

You currently only pay the additional rate of tax on income above £150,000. However, from 6 April 2023, additional-rate Income Tax will be payable on any income above £125,140.

If you already earn £150,000 or more, this change means you could pay an additional £1,200 in tax each year.

You can view a summary of the Income Tax changes in the table below.

Please note that Income Tax rates and thresholds are different in Scotland.

3. National Insurance is back to pre-2022 levels

National Insurance went through a lot of changes in 2022/23, starting with the 1.25% rate increase in April 2022 to help fund the government’s plan for health and social care. A few months later, Rishi Sunak raised the contribution threshold from £9,880 to £12,570.

However, in the September mini-Budget Kwasi Kwarteng reversed the 1.25% rate increase, bringing National Insurance rates back to where they started the tax year. This is expected to remain unchanged as we enter the new tax year in April 2023.

So, the rate that you pay on earnings between £12,570 and £50,270 has dropped back down to 12% from 13.25%. If you earn above £50,270 you will now pay 2% on these earnings, down from 3.25%.

4. Inheritance Tax threshold frozen

The nil-rate band for Inheritance Tax (IHT) has also been frozen. This will remain at £325,000 until April 2028. This has been unchanged since 2010/11.

The residence nil-rate band will remain at £175,000 in addition to the nil-rate band. This means that if you leave your home to your child or grandchild, they may only need to pay IHT on any portion of your estate that exceeds £500,000.

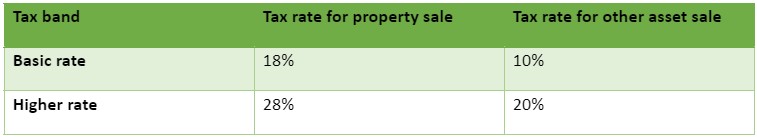

5. Capital Gains Tax annual exempt amount will reduce

The Capital Gains Tax (CGT) annual exempt amount is the amount of profit you can make on the sale of assets – such as a second home, shares that aren’t kept in an ISA, or personal possessions that are worth more than £6,000 (not including your car) – before you need to pay CGT.

The annual exempt amount is currently £12,300, but this will be reduced from April to £6,000. From April 2024, it will be reduced again to £3,000. This represents a significant reduction in the amount that you can make from the sale of an asset or second home before you are liable for CGT.

While the threshold for CGT is reducing, the rates will remain the same:

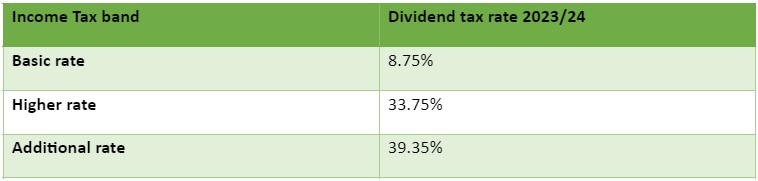

6. Dividend Allowance will also be reduced

Dividend Tax is the tax you pay on income that you receive from dividends, for example if you are a company shareholder. The Dividend Allowance is the amount that you can earn from dividends before this tax is payable.

From 6 April, the Dividend Allowance will also be halved. It’s currently £2,000 but in the new tax year this reduces to £1,000. Further cuts will happen from April 2024, reducing the allowance to £500.

If you take some or all of your income from dividends, this could mean that you pay more tax from April.

The rates of Dividend Tax, however, will remain the same:

7. Council Tax could rise for some

Local councils can already raise Council Tax by up to 2.99% without it requiring a local referendum. This increases to 3% from April, plus an additional 2% if the council qualifies for the social care precept. This means that your Council Tax could be increased by a maximum of 5% without your local council needing to hold a vote.

Councils in Scotland will be permitted to make unlimited Council Tax increases in 2023/24, but they have been urged by the Scottish government to act responsibly given the cost of living crisis.

8. Increase to the Stamp Duty threshold

In the mini-Budget, Kwasi Kwarteng announced an increase to the Stamp Duty threshold for first-time buyers and existing homeowners buying their next home.

As a result, there is now no Stamp Duty payable on the first £425,000 of a property for a first-time buyer, or on the first £250,000 of a new home for existing homeowners. This means that the threshold in both instances has doubled.

Unlike many of the announcements from the mini-Budget, these changes have not been reversed and will remain in place until 31 March 2025.

9. Corporation Tax changes in 2023/24

If you pay Corporation Tax on profits from your business, it’s important to note that the rate will increase to 25% from April 2023 for businesses with annual profits of £250,000 or more. If your profits are £50,000 or less, you will pay 19% Corporation Tax, and any amount that falls between these two thresholds will be charged a marginal rate.

The increase has been a controversial suggestion since it was first announced by Rishi Sunak as chancellor in March 2021. It was scrapped by Kwasi Kwarteng in the mini-Budget, only to be reinstated by Liz Truss in October 2022. No further changes are expected to this in 2023.

Get in touch

If you’d like help with understanding how tax changes from April could affect you, and how to manage your wealth in a more tax-efficient way, we can help. Email enquiries@metiswealth.co.uk or call 0345 450 5670 today to find out what we can do for you.

Please note

The tax treatment is dependent on individual circumstances and may be subject to change in future.

Tax Planning and Inheritance Tax Planning are not regulated by the Financial Conduct Authority.