The past 18 months have been a tough time for the UK economy. The aftermath of the Covid pandemic combined with the start of the war in Ukraine and global political uncertainty gave way to rapidly rising prices and a volatile stock market.

Luckily, as 2023 gets going, there are also lots of positive news stories to be found. So, if you’re wondering what this year could have in store for the UK economy, read on for five reasons to feel optimistic.

1. Inflation is likely to fall in 2023

After it soared to 41-year highs in autumn of 2022, inflation dropped to 10.1% in January 2023 from 10.5% in December 2022.

Inflation has caused a big squeeze on household budgets across the country and led to the Bank of England (BoE) raising interest rates at a significant rate. The good news is that inflation seems to have peaked at 11.1%, and, according to the BoE, it is likely to fall throughout 2023 before settling back to the 2% target in the middle of 2024.

As a result, the BoE’s rate rises have already begun to slow down, meaning that the cost of borrowing could also reduce throughout this year from the high rates we saw at the end of 2022.

2. Business is booming in the UK

Between 2021 and 2022, according to the government website, 32,000 employing businesses were set up in the UK, which amounts to a 2.3% increase. This is a much bigger increase than we saw between 2020 and 2021 (3,000, or an increase of 0.2%), and even more so than 2018 to 2019, before the pandemic hit (in that year, 21,000 new employing businesses were set up, a 1% increase).

The fact that more businesses are being set up and employing people is a reason for optimism as employment rates are intrinsically linked to economic growth. When there are more jobs, more people have disposable income which can be spent to help businesses grow further, and the cycle continues.

According to a report by Sifted, 2022 also saw more companies achieve “unicorn” status (startups that are valued at more than $1 billion) in the UK than anywhere else in Europe. In total, 11 companies reached unicorn status in the UK, including fintech companies SumUp and GoCardless.

As well as providing more job opportunities, unicorn companies also boost the economy by creating competition with overseas companies and bringing innovation to the market.

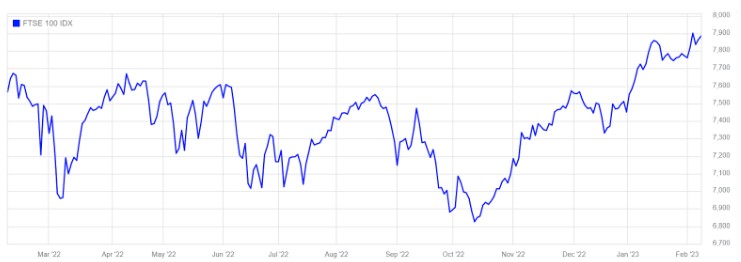

3. The FTSE 100 has hit an all-time high

The FTSE 100 index is performing especially strongly at the moment. After outperforming most other stock indices in the world in 2022 as reported by Reuters, it went on to hit an all-time high on 3 February and another on 8 February.

Source: London Stock Exchange

The FTSE 100 is a UK index made up of the 100 largest companies on the UK stock exchange. Many of the companies are internationally focused, so they don’t take their earnings just from the UK. This means that even if the UK economy is weak, the index can still thrive, as was the case in 2022.

Despite this, the FTSE 100 is often used as an indicator of the health of the UK economy. A soaring stock market generally suggests that investors are feeling optimistic for the future, which is usually a good thing for the economy.

4. Gilt yields and sterling are stabilising

After Kwasi Kwarteng’s mini-Budget in September, the value of the pound plummeted against the dollar to a low of 1.05.

This has been a major contributing factor to rising inflation, as many retailers buy their stock in dollars. This means that goods that need to be imported are more costly when the pound is weak against the dollar.

The good news is that the pound seems to have stabilised. It’s now risen back to 1.21 against the dollar as of 8 February 2023.

Source: Trading Economics

Gilt yields were also affected by the mini-Budget. In the wake of investor nerves following market volatility, the cost of government borrowing rose from just over 3% to close to 4.5% for 10-year gilts. This had big implications on public finances as government debt currently stands at around £2 trillion.

Following intervention by the BoE and the reversal of many of Kwarteng’s controversial plans, 10-year gilt yields have also stabilised to around 3.24%, putting the UK in a much stronger position for 2023.

5. Economic events move in cycles

As well as all of these positives, keep in mind that economic events tend to happen in cycles.

This means that whatever the current conditions are in the economy – good or bad – they’re only temporary. Sometimes they last for a short time, and sometimes they last a bit longer. But sooner or later, conditions are very likely to change.

So, even if the UK does experience a recession in 2023, it’s likely that by the end of the year, the economic outlook will be brighter.

Get in touch

Here at Metis Wealth, we know that regardless of what’s happening in the economy, your own financial goals and circumstances are unique. That means that the financial advice you receive should be tailored to you, so that you can achieve your goals.

If you’d like to make sure 2023 is full of good news about your own personal finances, we’re here to help. Email enquiries@metiswealth.co.uk or call 0345 450 5670 today to find out what we can do for you.

Please note

Past performance is not a guide to future performance, nor a reliable indicator of future results or performance.