There’s no doubt that Inheritance Tax (IHT) receipts are on the rise. Professional Adviser reports that the tax brought in £0.6 billion in April 2023, £0.1 billion higher than the same period last year.

The growth in IHT receipts is due in part to a freeze on the nil-rate bands, or the minimum threshold above which IHT is due on an estate after someone passes away.

In his autumn statement in November 2022, chancellor Jeremy Hunt announced that IHT thresholds would remain frozen until 2026. This means that the nil-rate band will stay at £325,000 (and £175,000 for the residence nil-rate band) until April 2028.

The freeze has been called a “stealth tax” because, even if it doesn’t affect you or your family immediately, as house prices rise with inflation, more people are likely to find themselves in the position of having to pay IHT on inherited estates. Indeed, the Office for Budget Responsibility predicts that IHT could raise an additional £3 billion for the Treasury over the next six years.

In light of this prediction, it’s prudent to ensure you review your estate’s potential IHT liability as part of your financial plan and decide how you might reduce your liability before you pass away.

One of the most popular ways to do this is to gift wealth during your lifetime, but the rules around gifting and IHT can be complex.

If this is something you’re considering, read on to learn five ways you could gift your wealth to family, friends, and loved ones to reduce the value of your estate for IHT purposes.

1. The annual exemption allows you to gift £3,000 a year free from IHT

Each tax year, you are permitted to gift up to £3,000 tax-free to anybody you like, and the gift will immediately be considered outside of your estate for IHT purposes. If you’re married or in a civil partnership, as a couple you can combine your allowances and gift a total of £6,000.

You can also “carry forward” any unused allowance from the previous tax year. So, if you didn’t use your allowance in the last tax year, you could gift a maximum of £6,000 in this tax year (or £12,000 as a couple). You can only carry forward for one year, so any unused allowance from previous years would be lost.

2. You can gift your child £5,000 for a wedding or civil ceremony

You can gift up to £5,000 to your own child when they get married or enter into a civil partnership. If it’s your grandchild or great-grandchildren getting married, this allowance is reduced to £2,500, and if you’re gifting to anyone else under these circumstances, the allowance is £1,000.

This allowance is on top of the annual exemption you read about above.

3. You can give as many gifts as you like up to the value of £250 each

You can gift up to £250 to as many people as you’d like each tax year.

The only caveat is that this doesn’t apply if you have used another allowance on the same person. If they have already received £3,000 from you in that tax year, for example, then the additional £250 would be considered above the threshold of your annual exemption and could be liable for IHT later on.

However, provided each person you gift to has not been in receipt of any other financial gifts from you that tax year, your £250 would not be liable for IHT after you pass away.

4. You can make unlimited regular gifts using surplus income

During the cost of living crisis, a lot of people have wanted to help family members or friends financially. As well as being able to help your loved ones to feel more financially secure, gifting money on a regular basis from surplus income can also help to reduce your IHT liability.

There are a few criteria that you need to meet if you want to gift in this way. The first is that the gift must not cause you to reduce your own standard of living. Second, you must be using surplus income to fund the gift rather than your savings or investments.

Provided your regular financial gift meets these criteria, you can give this in addition to your £3,000 annual exemption.

5. Larger gifts could be free from IHT if you live for 7 years after giving them

If you choose to make larger gifts than those covered by the allowances you’ve read about above, there is a way that they could still be considered outside of your estate when you pass away. It’s important to note that any gifts you give under this allowance must be given entirely as gifts; for example, if you gift a property to someone, you cannot continue to live there unless you are paying rent at the market rate.

If you live for more than seven years after you have given the gift, regardless of the amount, that gift is considered outside of your estate for IHT purposes.

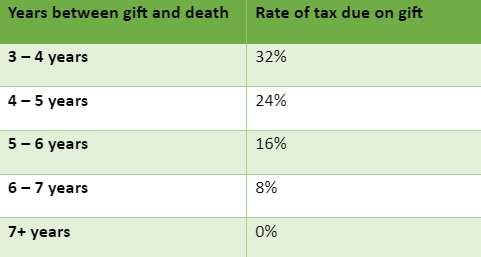

Should you die within seven years, there is a sliding scale of how much tax would be due on gifts of this nature. This is known as “taper relief”, and the rates applied are shown below.

Of course, it’s not always possible to be certain that you will outlive your financial gifts in this way, so it’s important to keep a written record of the gifts you have given. This will mean that, when the time comes, it’s clear which allowances you have made use of so that your estate and IHT liability can be calculated accurately.

Get in touch

Gifting your wealth is just one way to minimise your estate’s potential IHT liability. If you’d like to learn more about how we can help you to calculate the potential liability of your estate and create an estate plan that ensures you can pass on the assets you choose to your loved ones, please get in touch.

Email enquiries@metiswealth.co.uk or call 0345 450 5670 today to find out what we can do for you.

Please note

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.