It’s well known that Inheritance Tax (IHT) is by far one of the UK’s most-hated taxes and it’s not hard to see why. After working hard to build wealth so your loved ones can enjoy a comfortable lifestyle, the prospect of losing a large portion of it when you pass away can be an unpleasant one.

According to a study by Canada Life, two-fifths of Brits worry about how much IHT they may have to pay. Despite this, almost three-quarters of people surveyed stated that they had taken no actions to reduce their liabilities.

If you want to leave more money to your loved ones when you pass away, there are a few things you can do. Read on to find out more about how this tax could affect you, as well as three useful ways you can reduce the size of your tax bill.

Inheritance Tax could eat away at the wealth you worked so hard to build

The standard rate of IHT stands at 40% of your wealth and is applied to the value of your assets above a tax-free threshold called the “nil-rate band” (NRB). In the 2022/23 tax year, this limit stands at £325,000.

On top of this, if you pass your main residence on to your children or grandchildren, you can also benefit from an additional residence nil-rate band (RNRB) of £175,000. This means that you can potentially leave up to £500,000 to your loved ones tax-free.

Furthermore, if you’re married or in a civil partnership, you can also pass on any unused NRB or RNRB on to your partner when you pass away, or vice versa if you outlive them. This means you could potentially pass on up to £1 million without incurring any IHT.

While this figure may sound like a lot, rising inflation may mean it could be easier than you think to surpass the threshold.

According to government projections, the amount of IHT that Brits have to pay is set to rise sharply in the near future. Figures published by FTAdviser show that between 2022 and 2027, families are set to pay £37 billion.

If you want to minimise your tax liabilities, here are three useful tips that could help you.

1. Gift some of your wealth

If you want to reduce the size of your estate, gifting money or assets to your loved ones can be a great way to do this. Each tax year, (6 April to the following 5 April) you have a gifting allowance, which enables you to give wealth away without it being included in the value of your estate.

In the 2022/23 tax year, the amount you can gift tax-free stands at £3,000 and you can also carry forward one years’ worth of unused allowance.

You can make unlimited gifts of £250 to whoever you like, as long as they’re not the same person who already received your £3,000 exempt gift.

On top of this, you also have a gifting allowance for weddings, and the amount you can give depends on your relationship to the person who’s getting married. You can gift up to £5,000 for a child, £2,500 for a grandchild, and £1,000 to anyone else.

It’s also important to remember that these allowances are for each individual, so if you have a spouse or partner then they are each effectively doubled!

Finally, it’s also worth bearing in mind that, theoretically at least, you can make a gift of any size, and have it fall outside your estate, as long as you survive the gift by seven or more years.

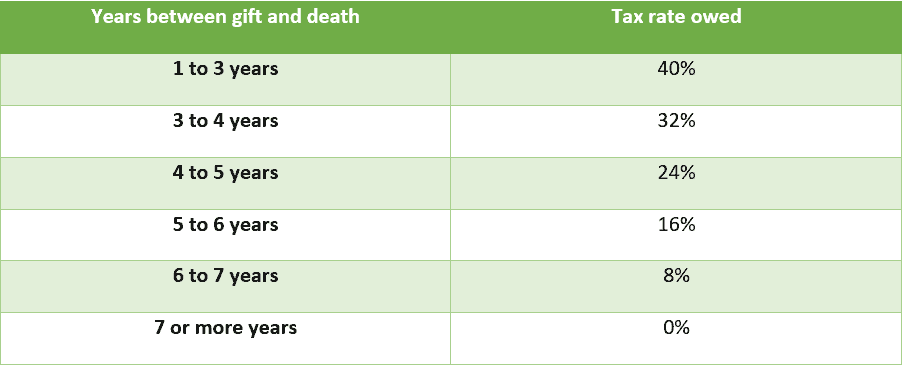

If you pass away before this, the amount of IHT your loved ones will have to pay depends on “taper relief”. Essentially, the rate of tax depends on how soon you died after making the gift, as you can see on the graph below:

Of course, it’s important to note that taper relief only applies to the value of your estate that exceeds the NRB. So, if you make a gift of less than £325,000 and died five years later, the gift will simply use up your NRB and won’t be subject to taper relief.

2. Place some of your wealth in a trust

Trusts can be another useful estate planning option to consider if you want to protect your wealth from IHT when you die.

Essentially, this involves locking a portion of it away for an intended recipient, known as the “beneficiary”, until a time of your choosing. You also appoint a “trustee” whose job it is to manage the wealth on the beneficiary’s behalf.

Not only can trusts be useful for ringfencing a portion of your wealth, but they can also be a tax-efficient option. This is because IHT for the assets held in some types of trust can be calculated in a different way, saving you money.

Not only can this be useful for helping you with estate planning, but trusts also give you a high degree of control. That being said, the tax rules surrounding them can sometimes be complicated, so it can be useful to work with a planner if you’re considering this option.

3. Draw your income in retirement in a tax-efficient way

Another valuable strategy to reduce your IHT bill is to draw your tax income in retirement in a tax-efficient way. This is because while most assets count towards the value of your estate, your pensions may not.

As such, when you retire it can be useful to draw income from your investments and savings first. Doing so can mean that your loved ones will be able to inherit your pension fund and won’t have to pay IHT on its value.

Of course, if you’re considering this option then it’s important to also be aware of other tax issues that you may run into, such as Capital Gains Tax (CGT).

Get in touch

If you want to cut your IHT bill and leave more money to your loved ones, we can help. Please email enquiries@metiswealth.co.uk or call 0345 450 5670.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.