Diving into the world of high-growth tech stocks can be a thrilling, albeit turbulent experience. Few companies exemplify this better than Nvidia, a tech company that designs and manufactures computer chips and graphics cards.

Indeed, the company’s recent performance has been a case study in riding out market volatility.

Nvidia recently made headlines by becoming the most valuable company in the world, with CNN stating it had achieved a market capitalisation of $4 trillion in July 2025.

However, this surge came after a period of significant fluctuation.

In January 2025, Reuters reported that Nvidia had experienced a dramatic overnight loss of $593 billion in market capitalisation. This dip followed the announcement of a new, lower-cost AI model by a Chinese startup.

This rollercoaster ride of massive gains and sudden downturns can provide several powerful lessons for investors. Here’s what you need to know.

Nvidia cemented itself as a tech giant, but its journey has had ups and downs

A decade ago, Nvidia was worth just more than $10 billion. Forbes notes that sustained growth and high demand meant that by 2023, it had achieved a market capitalisation of $1 trillion.

Just one year later, it tripled that figure.

This meteoric rise was largely due to the AI boom, as Nvidia manufactures powerful computing hardware that makes it possible to develop and deploy AI systems.

The business experienced massive growth as tech companies worldwide began purchasing Nvidia’s hardware to power their AI software. At the time of writing, its biggest customers include OpenAI, Tesla, Meta, and Amazon.

However, in January 2025, a Chinese startup introduced its latest AI model, “DeepSeek R1”.

DeepSeek was said to rival technology developed by OpenAI, creators of ChatGPT, due to its efficiency, meaning that Nvidia’s powerful hardware may no longer be required for AI to perform well.

Indeed, DeepSeek’s popularity and growth potential rattled investors and wiped billions off Nvidia’s market value, with Reuters reporting a significant single-day loss of $593 billion.

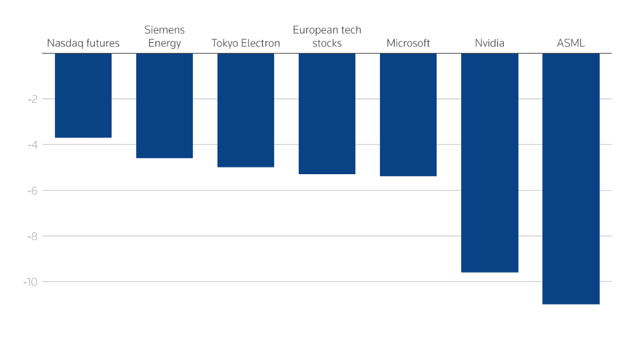

While not the only company to experience share price drops, Nvidia was certainly one of the worst hit, based on the graph below.

Source: Reuters

Like most large companies, Nvidia’s share price did bounce back. The company met its landmark $4 trillion market capitalisation and outranked other household tech names, such as Microsoft, Apple, and Amazon, in the process.

There is plenty to learn from Nvidia’s tumultuous journey, but these three important lessons may be at the top of the list.

Lesson 1: Understand the importance of diversification

Nvidia’s most recent increase in volatility serves as a stark reminder of the risks investors face when holding a limited portfolio.

While the potential for substantial returns from a single, high-growth stock can be tempting, it could also expose you to significant levels of risk.

While DeepSeek was a relatively new competitor on the AI scene at the time, the market’s reaction to its introduction demonstrates how quickly circumstances can change.

Here, diversification can help spread the risk.

By not keeping all your eggs in one basket, you can protect your portfolio from the effects of a single company or industry experiencing a significant downturn.

For example, a diversified portfolio might include:

- A mix of shares that include, but are not limited to, tech stocks

- Shares in a variety of industries or with a global range, rather than concentrated stocks

- Bonds, which can be an effective hedge against high-risk investments

- Other assets such as property.

Maintaining a balanced and diverse portfolio means that you’re less likely to feel the effects of a decline in one area. Generally, this can help smooth out your returns over time.

Lesson 2: Learn the dangers of attempting to time the market

Nvidia’s turbulent performance highlights a common investor pitfall.

Attempting to “time the market” can often lead to lower returns than “time in the market”.

For example, if an investor had sold their shares during the downswing, they would have missed out on Nvidia’s record-breaking rally.

Indeed, history has shown that the best and worst days in the market are often clustered together, and investors who try to move in and out of the market can easily miss some of the most significant periods of growth.

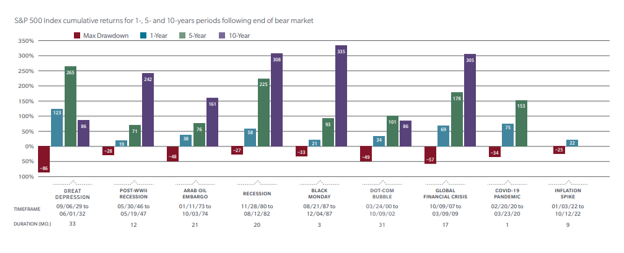

In the graph below, you can see how even the most dramatic downturns experience some form of prolonged market recovery.

Source: MFS Investment

So, instead of trying to predict the market’s next move, a more productive long-term strategy could be to remain invested and focus on other, more disciplined approaches, such as pound-cost averaging.

This involves investing a fixed amount of money at regular intervals, regardless of the stock’s price.

Adopting this strategy means that you can buy more shares when prices are low and fewer when they are high, which can reduce the effects of short-term volatility on your overall returns.

Lesson 3: Focus on concrete investing principles rather than following the hype

Narratives surrounding high-growth stocks, such as Nvidia’s, are often packed with hype and speculation. While the company’s growth is undeniable, and its role in the AI sector is significant, making financial decisions based on short-term sentiment alone can be limiting.

A significant overnight gain, while exciting and impressive, doesn’t necessarily change the company’s long-term business prospects.

Rather, focus on a company’s underlying business fundamentals when making investment choices. These can include:

- Revenue and earnings growth

- The company’s competitive position

- Its future outlook.

Indeed, strong demand and a company’s position as a market leader are what matter for long-term investors, not the day-to-day fluctuations of stock prices.

While there will always be risk factors at play, focusing on sustained growth, diversity, and sound financial planning is key to a successful long-term plan.

Speak to a financial planner for individual guidance

What Nvidia’s most recent journey teaches us is that focusing on the long-term is often a portfolio’s most reliable defence against market fluctuations.

More than that, having and sticking to a financial plan can make all the difference when it comes to navigating market ups and downs.

This is an area we specialise in, offering guidance during market turbulence and acting as a sounding board when you want to make new financial decisions.

So, whether you’re new to the world of investing or have years of experience, we’re here to help.

Email enquiries@metiswealth.co.uk or call 0345 450 5670 today to find out what we can do for you.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.