September is often thought of as a slow month on the stock market in a phenomenon that’s been dubbed the “September effect”.

According to a MoneyWeek report, historical data seems to support the theory: the S&P 500 has experienced negative returns in the month of September for the past four years. The report suggests that the trend could be attributed to the increase in trading volumes, as investors return from summer holidays.

Regardless of whether markets follow these trends, it’s important not to base your investment decisions solely on this. Indeed, allowing the anticipation of underperformance to influence how you manage your money could have a detrimental effect on your wealth over time. Read on to find out why, and what to do instead to manage the risk of underperformance.

1. There are countless factors that can affect stock market performance, regardless of the time of year

The stock market is influenced by a range of factors, not the least of which being the decisions of millions of individual investors who are trading stocks every day.

Each investor has their own priorities, beliefs, and goals. So, it’s impossible to predict exactly how they might behave from one day to the next, not to mention how their actions might affect stock prices.

So, while the time of year might have some effects on stock market performance, these are arguably indirect influences. Moreover, it’s just one of myriad reasons why investors might choose to behave in a particular way, causing stock prices to rise or fall as a result.

Given that stock market performance is influenced by so many different people and possibilities, it seems unwise to expect a single factor such as the time of year to have a reliable and unequivocal outcome on stock values.

2. Short-term fluctuations are part and parcel of investing, but stock markets have trended towards growth over the long term in spite of this

Zoom in on a graph showing stock market performance and you’ll notice plenty of minor fluctuations in value on a day-to-day or week-to-week basis. But when you zoom out, it’s clear that most indexes have continued to grow, even if they have experienced significant volatility.

The first graph below demonstrates how the FTSE 100 fluctuated in value during September 2024. Yet when you consider the index’s returns over a 10-year period, as shown in the second graph, you can see that despite some sizeable fluctuations in value during that time, the index has continued to grow.

Source: Hargreaves Lansdown

If you were to change your investment strategy based on the short-term fluctuations seen each month or year, you could miss out on the long-term growth that stock market investing may offer. As such, it may be helpful to keep these graphs in mind if market volatility causes you to doubt your investment strategy.

3. Consistent investments over the long term may help you mitigate the impact of market volatility

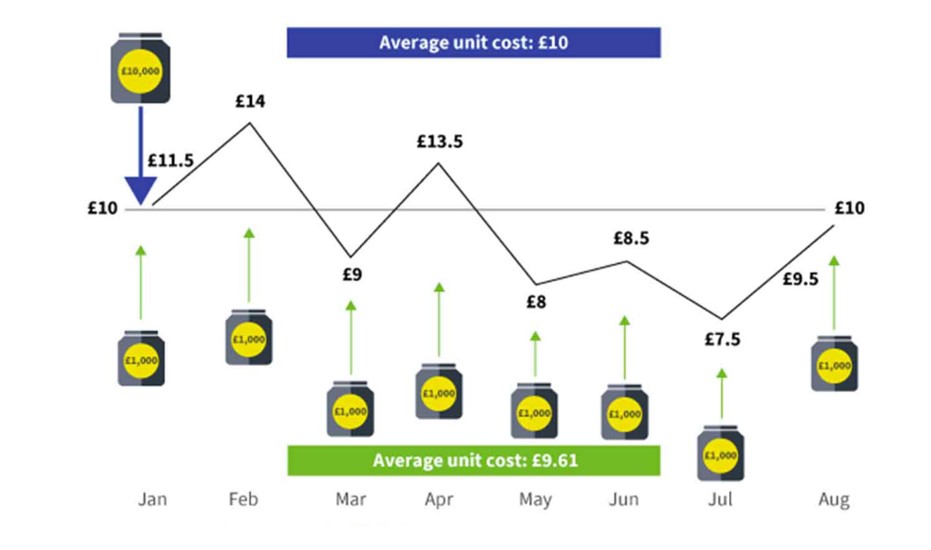

Though it can be disheartening to see your portfolio fluctuate in value, it is possible to reframe this into a positive. Lower stock values mean it is cheaper to buy more shares, which may soon grow in value. This is the idea behind an investment strategy known as “pound cost averaging”, which is illustrated in the graph below.

Source: Aviva

In this example, you have £10,000 to invest. If you invest the lump sum all at once, you commit to buying shares at the price they are that month (£10 each, in this example). From this point, you usually hope that the share price will rise, so that your investment grows.

Realistically, though, the share price is more likely to fluctuate, and this is where pound cost averaging comes in.

If, instead, you invest £1,000 a month for 10 months, you would be buying shares at a range of different prices as their value fluctuates. When prices rise, you’ll buy fewer, but when prices fall, you’ll be able to buy more.

Over time, this strategy means you end up paying the average market price for your shares. This could help mitigate the impact of market volatility on your portfolio and reduce the level of risk your wealth is exposed to.

Get in touch

To learn more about how we can help you to grow your wealth and achieve your long-term financial goals, please get in touch. Email enquiries@metiswealth.co.uk or call 0345 450 5670 today to start the conversation.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.